[Study] U.S. Government CMS Preferences and Trends

Takeaway: Government CMS preferences vary dramatically by level and size: While smaller cities favor specialized proprietary solutions, larger entities and States prefer flexible or enterprise solutions. That's why it's important to pick a CMS that fits your government’s context and needs.

Download: [View Only] CMS Usage Across US Cities, Counties, and States →

Rationale for the study

Effective government websites are necessary for engaging citizens, delivering services, and sharing information. The CMS powering these websites directly impacts their performance, making CMS selection a critical decision.

Choosing the right CMS can significantly improve content management efficiency, accessibility, security, and scalability. The wrong choice can lead to poor user experiences, security vulnerabilities, and costly maintenance.

With numerous CMS options available, both open source and proprietary, making an informed decision is essential to give your citizens the best user experience they can have with your website.

This study is a comprehensive analysis of CMS usage across U.S. cities, counties, and states. By examining the current landscape, trends based on government level and population size, and the adoption of open-source versus proprietary solutions, this study offers valuable insights to support informed CMS selection.

This study will:

- Identify the most popular CMS platforms used by cities, counties, and States, helping you benchmark your choices against industry trends.

- Discuss how CMS usage varies based on government level and population size, allowing you to make decisions based on the experiences of similar entities.

- Guide you on selecting between open-source vs proprietary CMS options, considering factors like cost, flexibility, and community support.

- Provide recommendations on how to evaluate and select a CMS that meets your organization's requirements.

The scope of this study encompasses identifiable cities, counties, and States within the United States, ensuring a broad and representative view of CMS usage in the government sector. Through rigorous data collection and analysis, we uncover key patterns, preferences, and factors influencing CMS adoption.

By leveraging the data-driven insights and practical guidance provided in this study, you can make strategic CMS choices that optimize your website's performance, enhance citizen engagement, and ensure the long-term success of your digital initiatives.

Looking to change your CMS? Share this study with your team

Methodology

To ensure the accuracy and comprehensiveness of our analysis, we employed a rigorous data collection and analysis process.

Data collection

- We obtained population data for U.S. states, counties, regions, cities, towns, and villages from the U.S. Census Bureau.

- We selected the following samples for our study:

- All 50 states plus the District of Columbia

- Top 1,000 counties and regions by population

- Top 1,000 cities, towns, and villages by population

- We manually identified and verified the official website for each government entity in our sample.

- We compiled a list of these official websites and used Wappalyzer, a web technology profiling tool, to identify the CMS platform used by each site.

- For websites where Wappalyzer could not detect the CMS, we conducted manual checks to determine the platform in use.

Data organization and analysis

- We categorized the data into three groups according to the census data: States, counties/regions, and cities/towns/villages.

- We further divided the States by population:

- Small: Less than 3 million residents

- Mid-sized: 3 million to 10 million residents

- Large: Greater than 10 million residents

- We also divided the counties and regions group by population (for purposes of the study, we’ll be referring to this group as “counties”):

- Small: Less than 150,000 residents

- Mid-sized: 150,000 to 1.5 million residents

- Large: Greater than 1.5 million residents

- We similarly divided the cities and towns group (for purposes of the study, we’ll be referring to this group as “cities”):

- Small: Less than 100,000 residents

- Mid-sized: 100,000 to 1 million residents

- Large: Greater than 1 million residents

- Within each category and size group, we identified the CMS platform used by each website and classified it as either open-source or proprietary.

- We calculated the market share distribution of CMS platforms within each government level and population size group and classified them as open-source or proprietary.

The population-based segmentation allows for meaningful comparisons across different sizes of government entities, providing you valuable insights in making CMS selection decisions.

Overall CMS usage landscape

This section provides a comprehensive overview of the CMS platforms used by U.S. government entities and examines the adoption of open-source versus proprietary solutions.

Most widely used CMS platforms by U.S. government entities

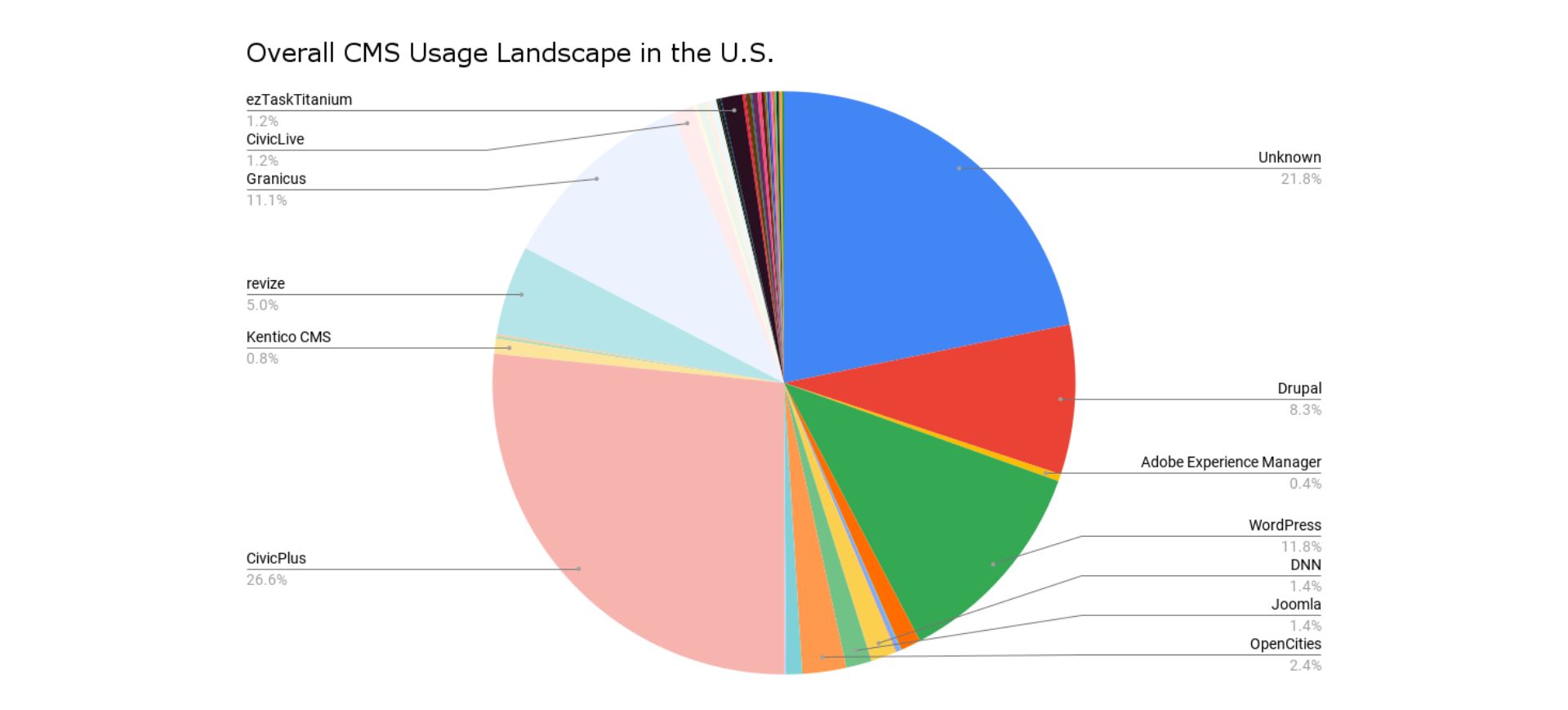

Our analysis reveals a diverse landscape of CMS usage across U.S. government websites. The top 5 CMS platforms (excluding the unknown platforms), in order of popularity, are:

- CivicPlus (26.6%)

- WordPress (11.8%)

- Granicus (11.1%)

- Drupal (8.3%)

- Revize (5.0%)

CivicPlus emerges as the clear leader, powering over a quarter of government websites in our study. This dominance suggests that many government entities value specialized solutions designed specifically for the public sector.

The significant presence of an unidentifiable CMS group (21.8%) indicates that a substantial portion of government websites either use custom-built solutions or CMS platforms that are not easily identifiable. This could reflect a mix of legacy systems, highly customized solutions, or emerging platforms.

WordPress and Drupal, two popular open-source options, collectively power 20.1% of the surveyed websites, demonstrating their strong presence in the government sector.

Open-source vs proprietary overall landscape

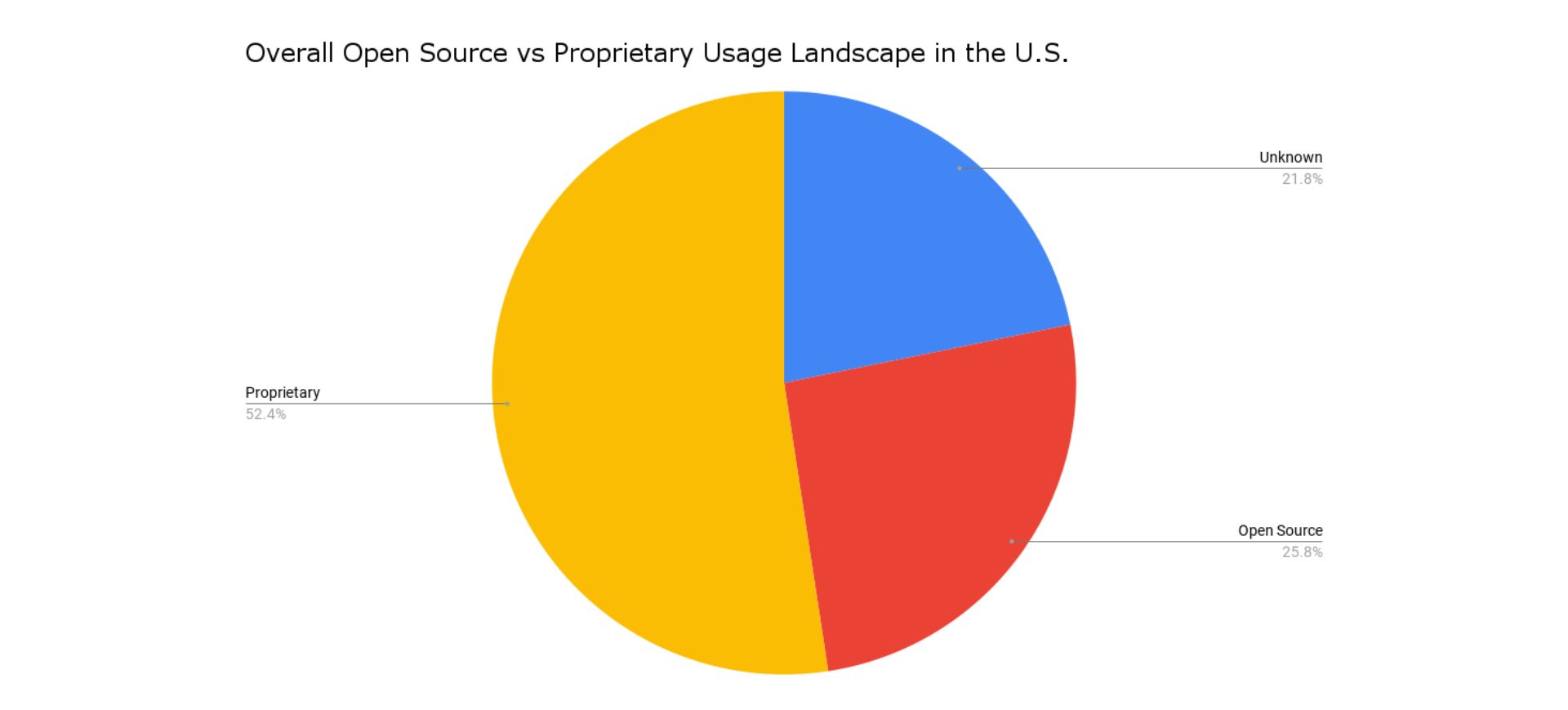

Our analysis shows a preference for proprietary CMS solutions among U.S. government entities:

- Proprietary CMS: 52.4%

- Open-source CMS: 25.8%

- Unknown: 21.8%

The dominance of proprietary solutions suggests that many government entities prioritize dedicated support, specialized features, and perceived security benefits associated with commercial platforms. The prevalence of government-specific CMS solutions like CivicPlus and Granicus contributes significantly to this trend.

However, the substantial share of open-source CMS usage (25.8%) indicates that a significant number of government entities still find value in the flexibility, cost-effectiveness, and community support typically associated with open-source platforms.

The large proportion of unknown CMS usage (21.8%) adds an element of uncertainty to the landscape since we cannot identify if the CMS used is proprietary or open source.

This diverse landscape shows the importance of carefully evaluating both proprietary and open-source options based on specific organizational requirements, resources, and long-term goals.

Read: Proprietary Website Migration for Government Sites →

CMS usage by government level

This section compares CMS preferences and trends across cities, counties, and States, providing insights into how different levels of government approach their CMS choices.

State level

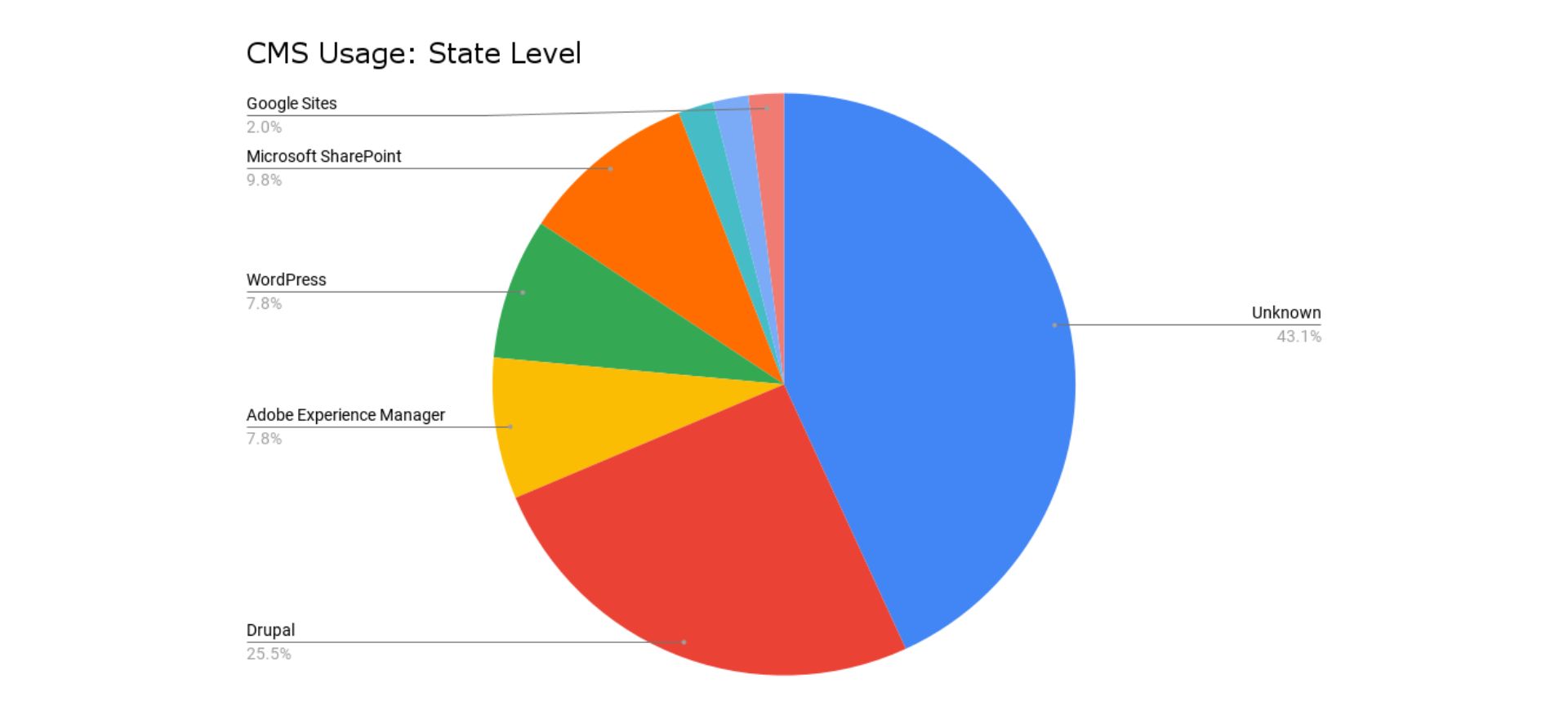

At the State level, 43.1% of governments use unidentifiable CMS platforms. This could indicate a preference for (or simple prevalence of) custom-built solutions or less common CMS platforms.

Key findings for State-level CMS usage:

- Drupal leads among identified CMS platforms at 25.5%

- Microsoft SharePoint follows at 9.8%

- WordPress and Adobe Experience Manager tie at 7.8% each

- Google Sites has a small presence at 2.0%

Read: 10 Reasons for Government to Love Drupal 10 →

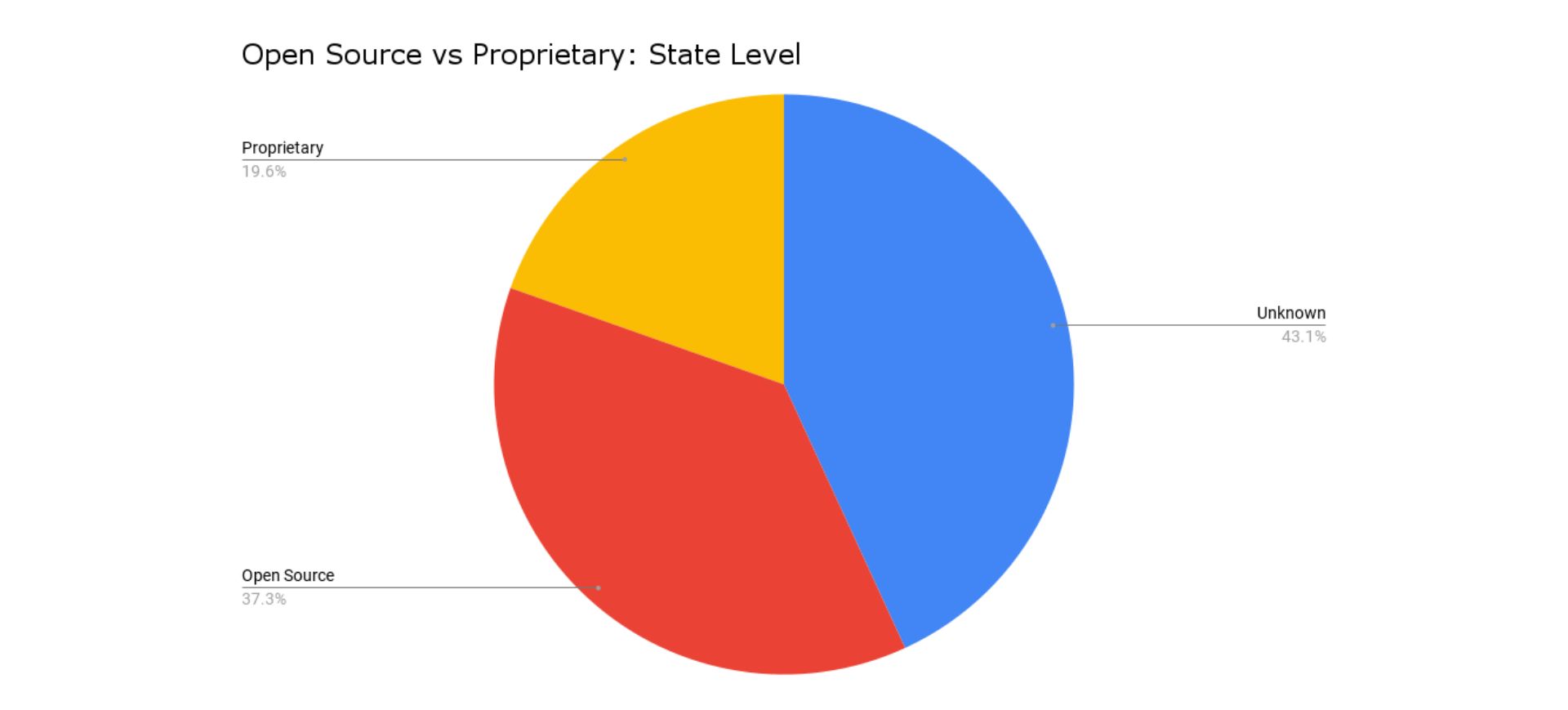

Open source vs proprietary split at the State level:

- Open-source CMS: 37.3%

- Proprietary CMS: 19.6%

- Unknown CMS: 43.1%

Governments at the State level show a strong preference for open-source solutions among identifiable CMS platforms, with Drupal and WordPress contributing significantly to this trend.

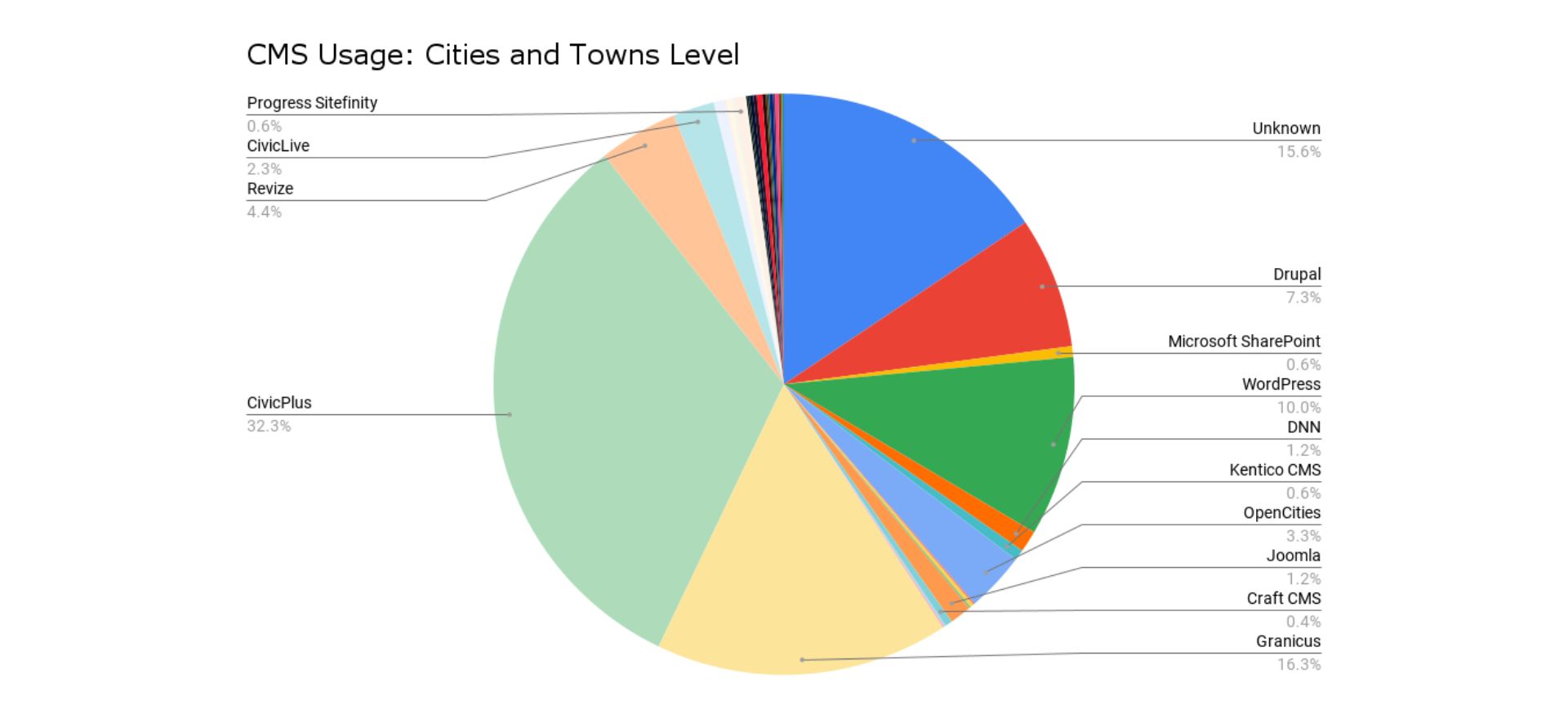

City level

Cities show a more diverse CMS landscape with a lower percentage of unknown platforms (15.6%) compared to the State government level.

Key findings for city CMS usage:

- CivicPlus dominates at 32.3%

- Granicus follows at 16.3%

- WordPress (10.0%) and Drupal (7.3%) maintain a significant presence

- Several other platforms like OpenCities, Revize, and CivicLive have notable shares

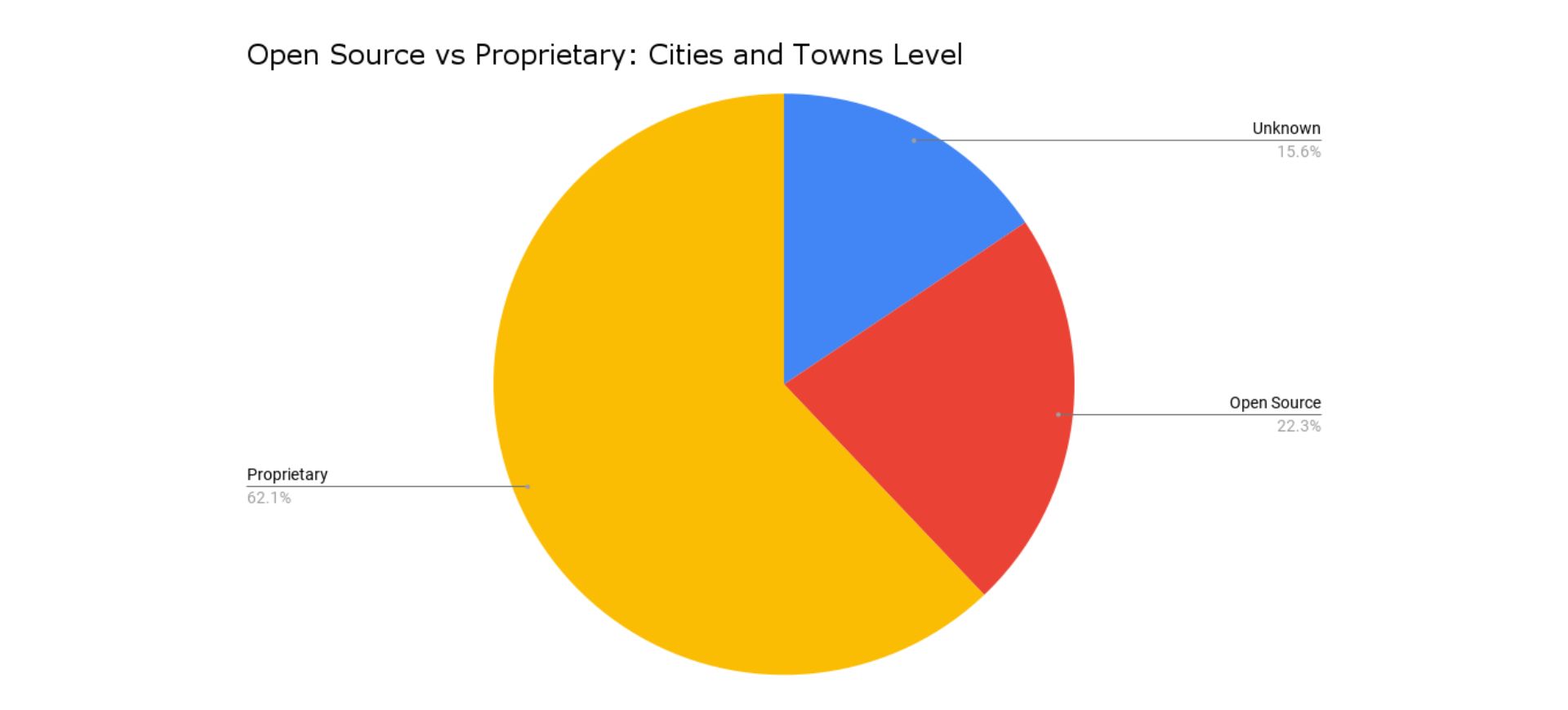

Open source vs proprietary split at the city level:

- Proprietary: 62.1%

- Open source: 22.3%

- Unknown: 15.6%

Cities and towns show a strong preference for proprietary solutions, particularly government-specific platforms like CivicPlus and Granicus.

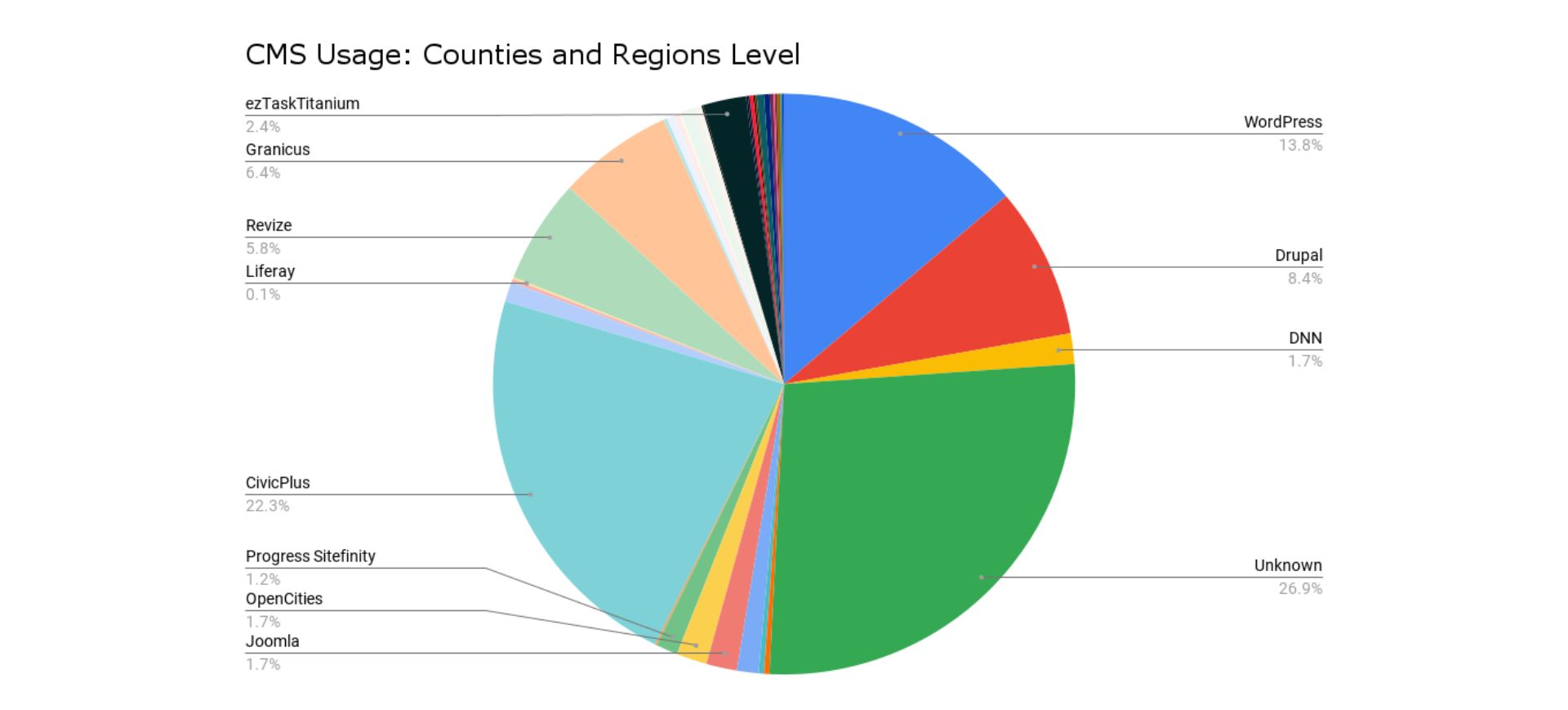

County level

Counties present a middle ground between States and cities in CMS diversity and unknown platform usage (26.9%).

Key findings for counties and regions CMS usage:

- CivicPlus leads at 22.3%

- WordPress follows at 13.8%

- Drupal maintains a significant presence at 8.4%

- Granicus and Revize also have notable shares at 6.4% and 5.8% respectively

Read: Drupal vs Revize for Government: A Comprehensive Guide →

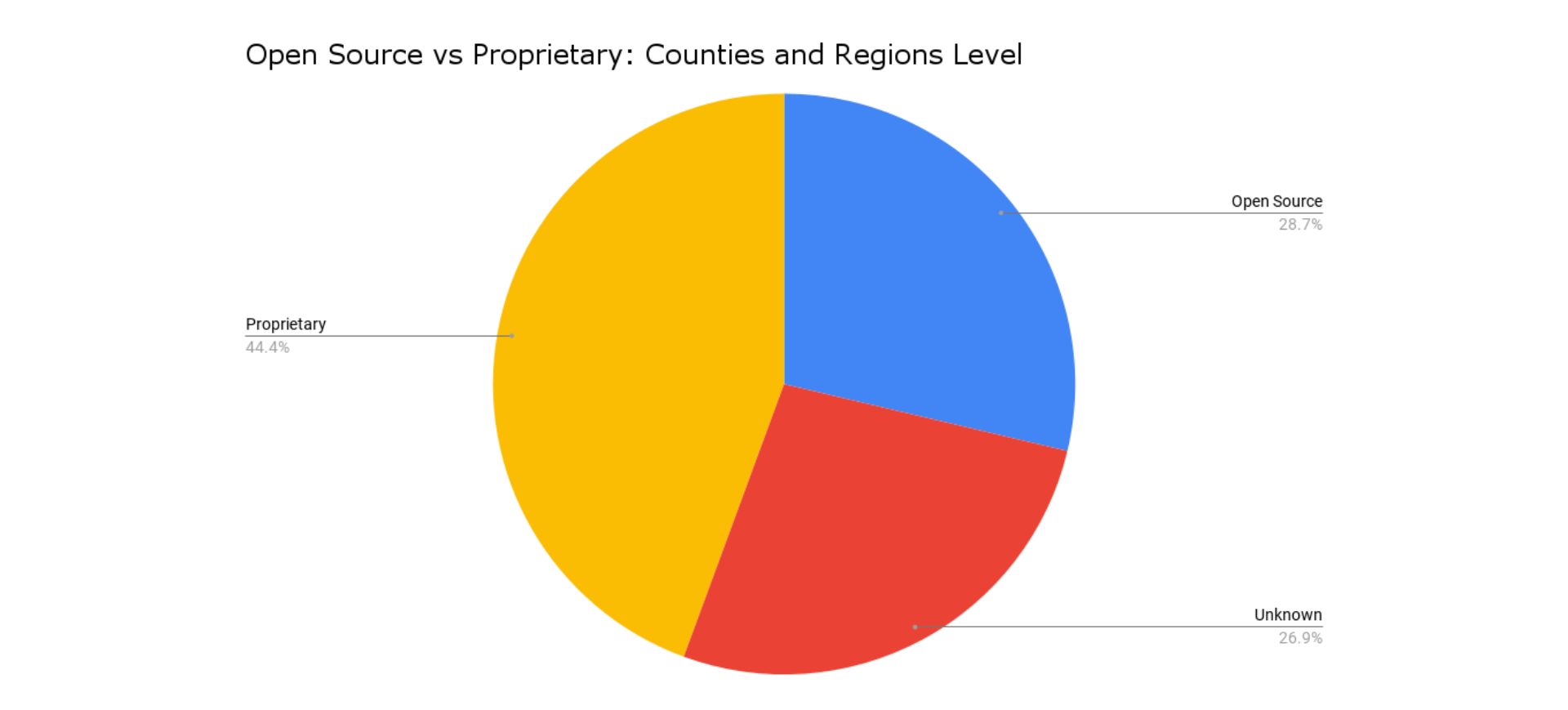

Open source vs proprietary split at the county level:

- Proprietary: 44.4%

- Open source: 28.7%

- Unknown: 26.9%

Counties, like cities, also lean heavily towards proprietary platforms.

Potential factors influencing CMS choices by government level

- State-level websites show a higher preference for open-source solutions, particularly Drupal, possibly due to greater in-house technical resources and complex content management needs.

- City-level websites favor proprietary, government-specific solutions like CivicPlus and Granicus. This could be due to these platforms offering out-of-the-box features tailored to local government needs.

- County-level websites show a slightly higher preference for open-source solutions compared to their city counterparts, but still lean towards proprietary solutions. This possibly reflects diverse needs and varying resource levels.

- The high percentage of unidentifiable CMS usage at the State level (43.1%) compared to cities (15.6%) and counties (26.9%) suggests that States may be more likely to use custom solutions or less common CMS platforms.

CMS usage and population size per government level

In this section, we compare CMS preferences and trends across the three government levels divided by their population (small, mid-sized, and large) providing further insights into potential connections between population size and CMS preferences.

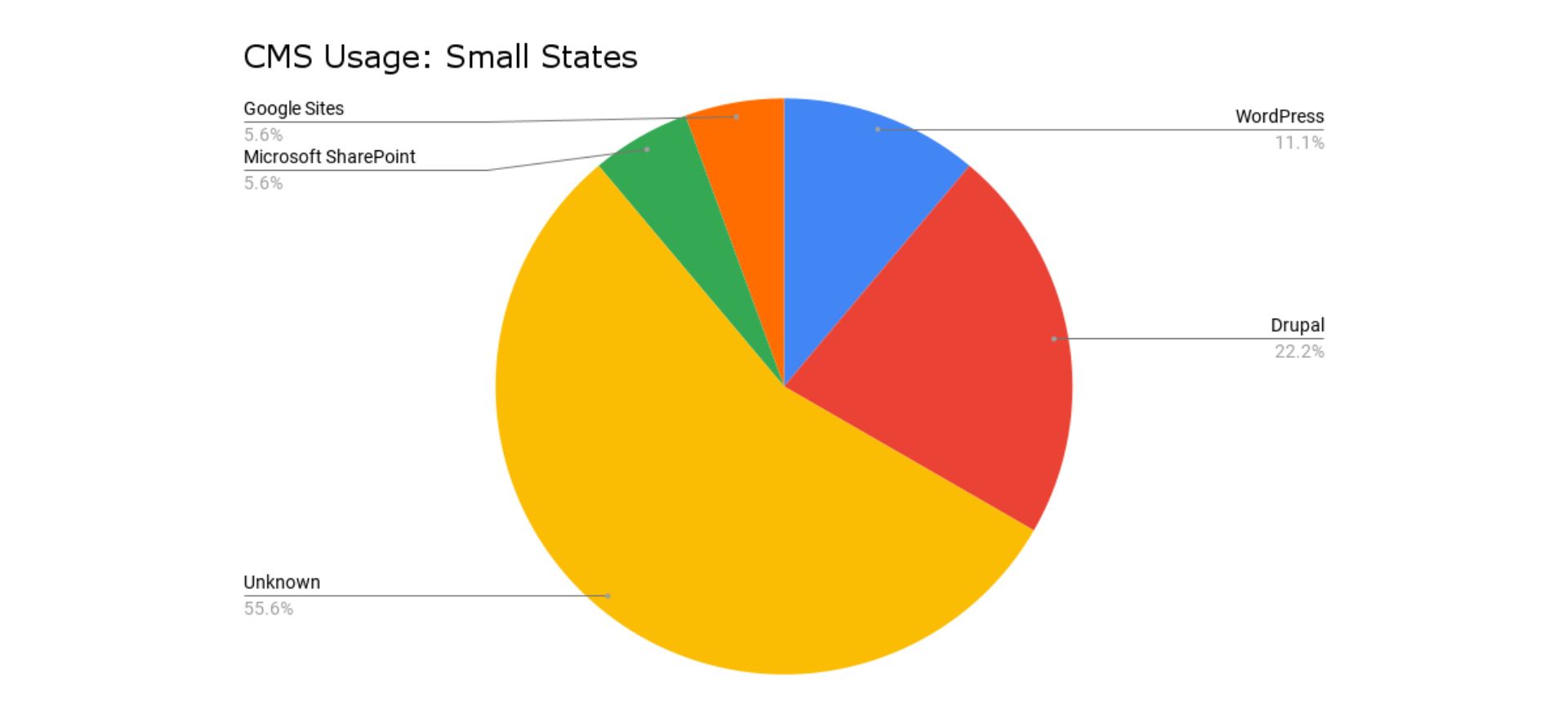

Analysis for small States (less than 3 million residents)

Key findings for CMS usage of small States:

- Drupal is the most popular identifiable CMS at 22.2%

- WordPress follows at 11.1%

- Google Sites and Microsoft SharePoint tie at 5.6% each

- A significant 55.6% of small States use unidentifiable CMS platforms

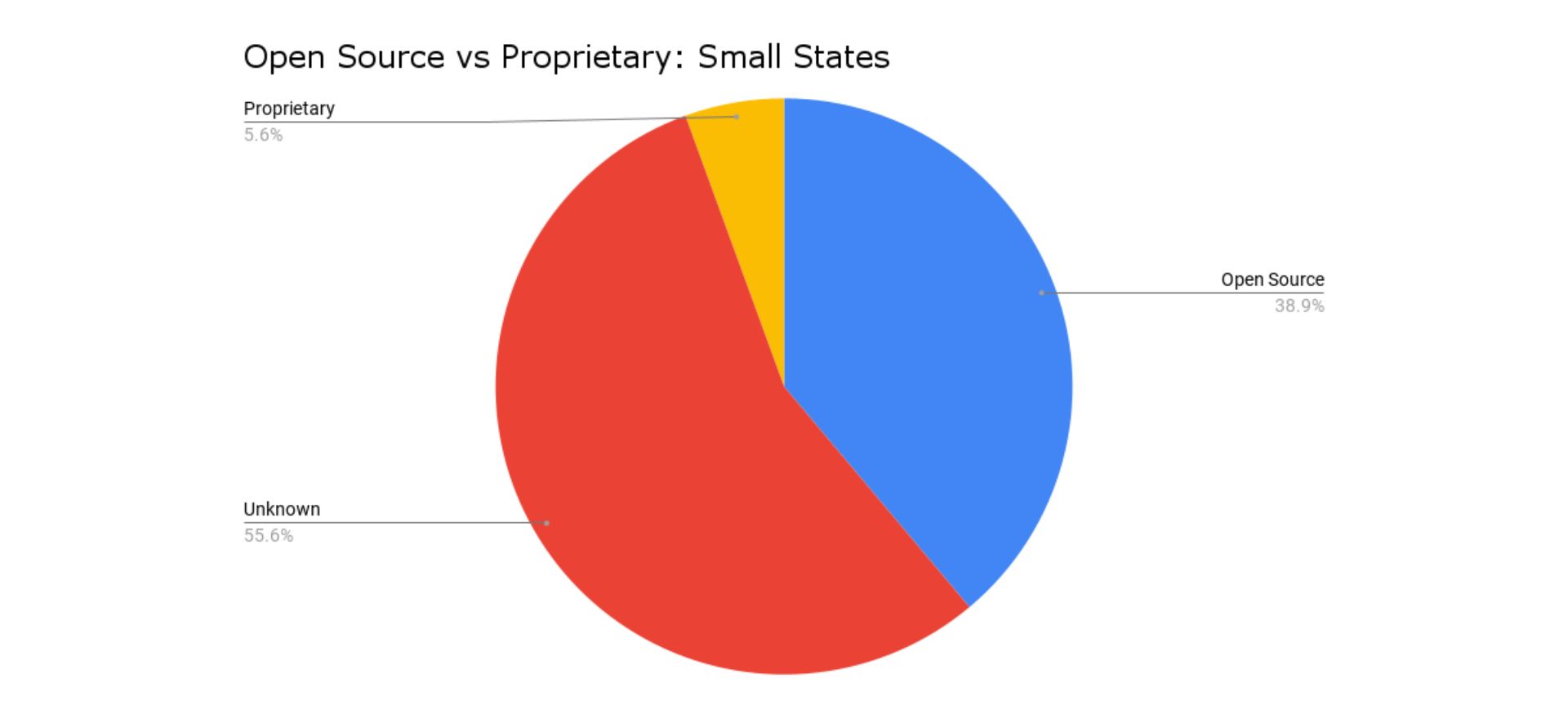

Open source vs proprietary split for small States:

- Open-source solutions are preferred, accounting for 38.9% of identified CMS usage

- Proprietary solutions are used by only 5.6% of small States

- The high percentage of unidentifiable CMS usage (55.6%) makes it difficult to draw definitive conclusions on actual preference at this level

Key insights for small States:

- There's a strong preference for open-source solutions, particularly Drupal, among identifiable CMS platforms.

- The high percentage of unknown CMS usage suggests that many small States might be using custom solutions or less common platforms.

- Proprietary solutions have a low adoption rate among small States.

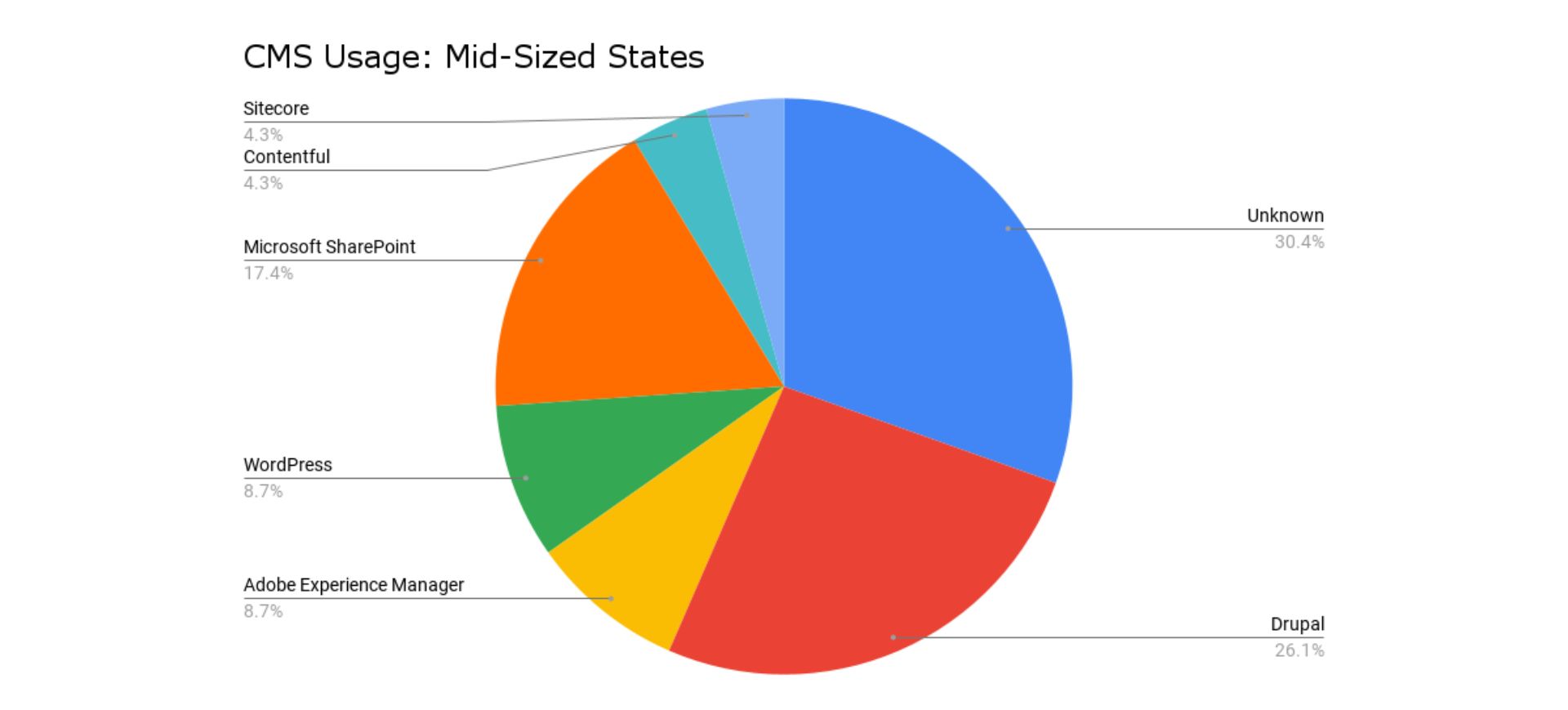

Analysis for mid-sized States (3 to 10 million residents)

Key findings for CMS usage of mid-sized States:

- Drupal remains the most popular identifiable CMS at 26.1%

- Microsoft SharePoint is second at 17.4%

- WordPress and Adobe Experience Manager tie at 8.7% each

- Sitecore and Contentful each have a 4.3% share

- 30.4% of mid-sized States use unidentifiable CMS platforms

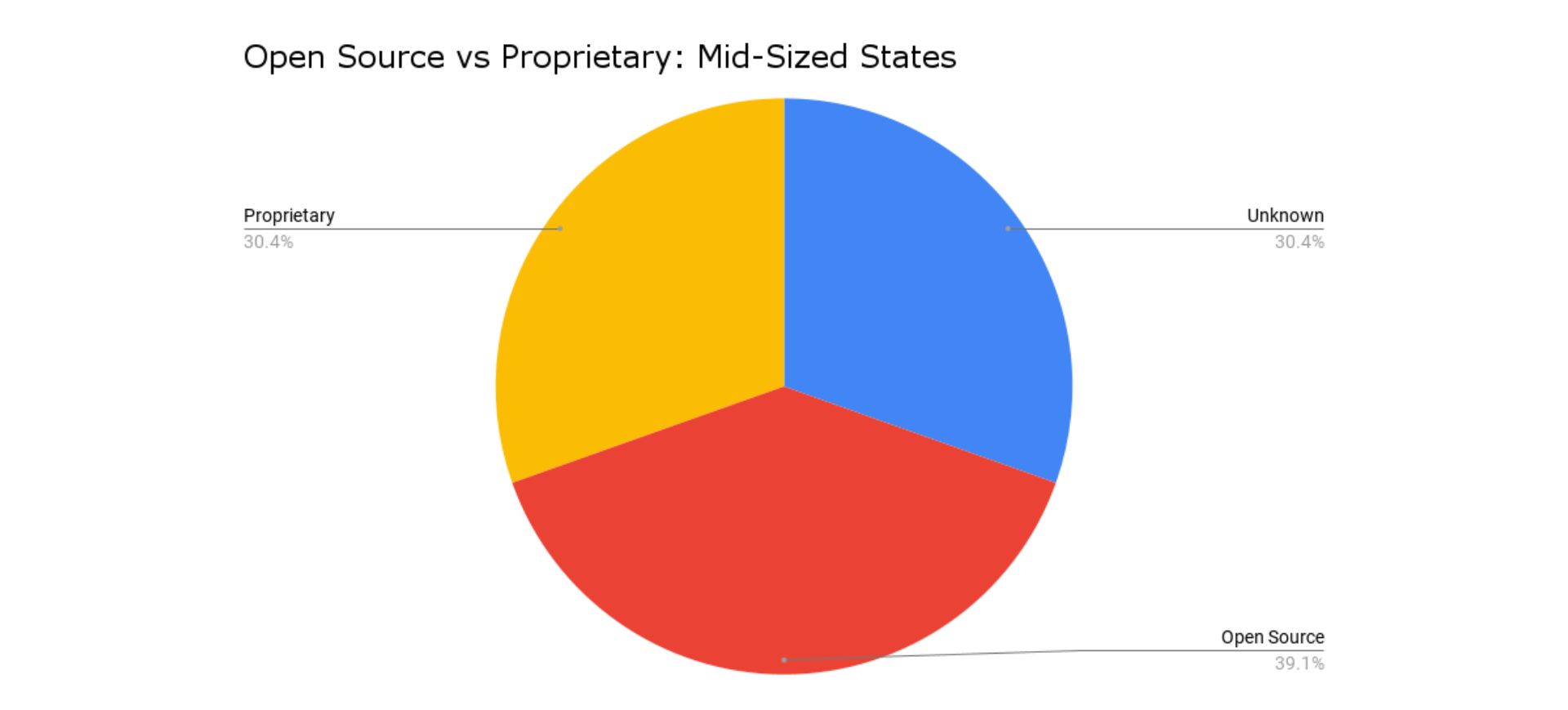

Open source vs proprietary split for mid-sized States:

- Open-source solutions are still preferred, accounting for 39.1% of CMS usage

- Proprietary solutions have increased significantly to 30.4%

- Unidentifiable CMS usage has decreased to 30.4% compared to small States

Key insights for mid-sized States:

- Open-source solutions, particularly Drupal, maintain popularity across both small and mid-sized States.

- Mid-sized States show a significant increase in the adoption of proprietary solutions, suggesting they may have more resources or different requirements that lead them to choose commercial platforms.

- The decrease in unknown CMS usage for mid-sized States might indicate more standardized or identifiable CMS choices as the State size increases.

- Mid-sized States demonstrate a more diverse CMS landscape, possibly reflecting more varied needs or greater resources for evaluating different solutions.

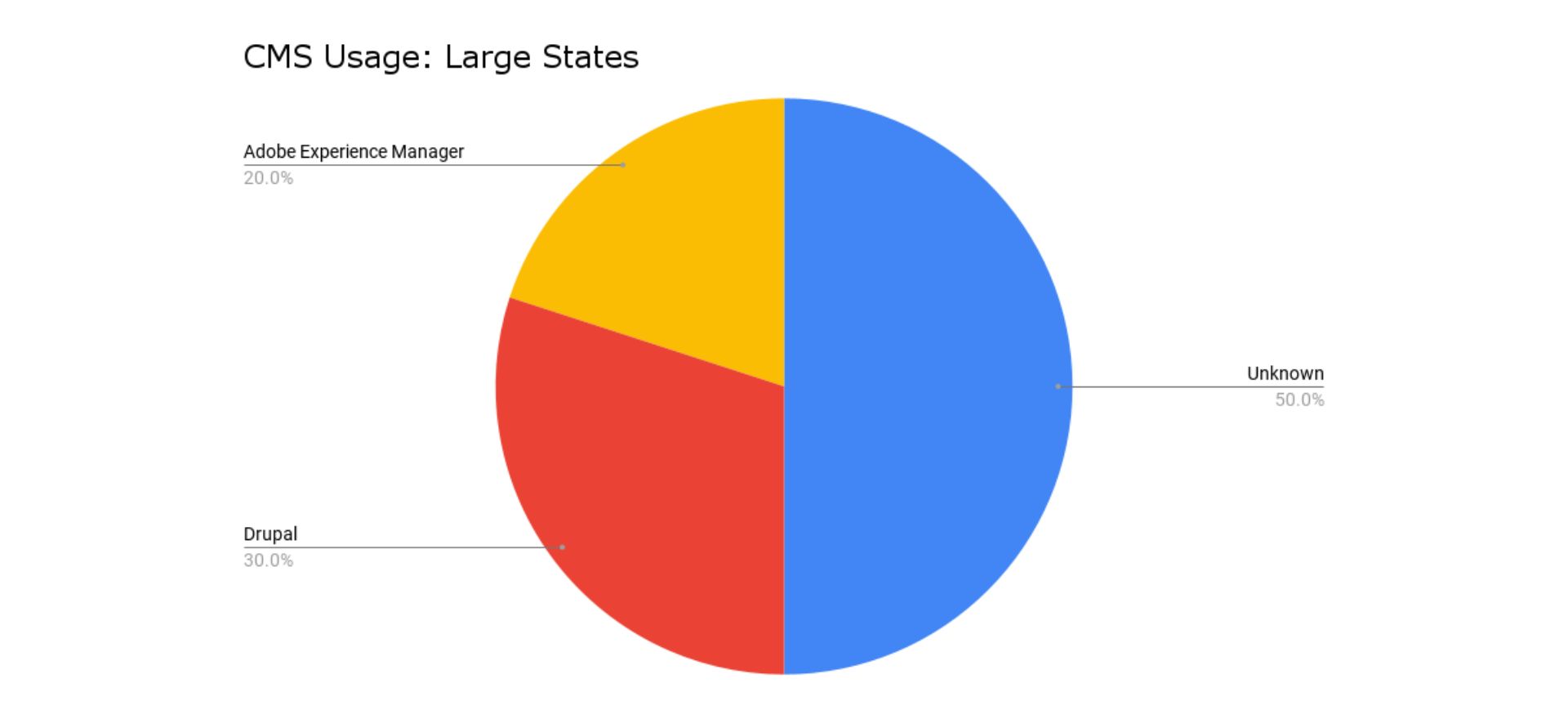

Analysis for large States (more than 10 million residents)

Key findings for CMS usage of large States:

- Drupal remains the most popular identifiable CMS at 30%

- Adobe Experience Manager follows at 20%

- 50% of large states use unknown or unidentifiable CMS platforms

Read: Adobe Experience Manager vs Drupal for Government →

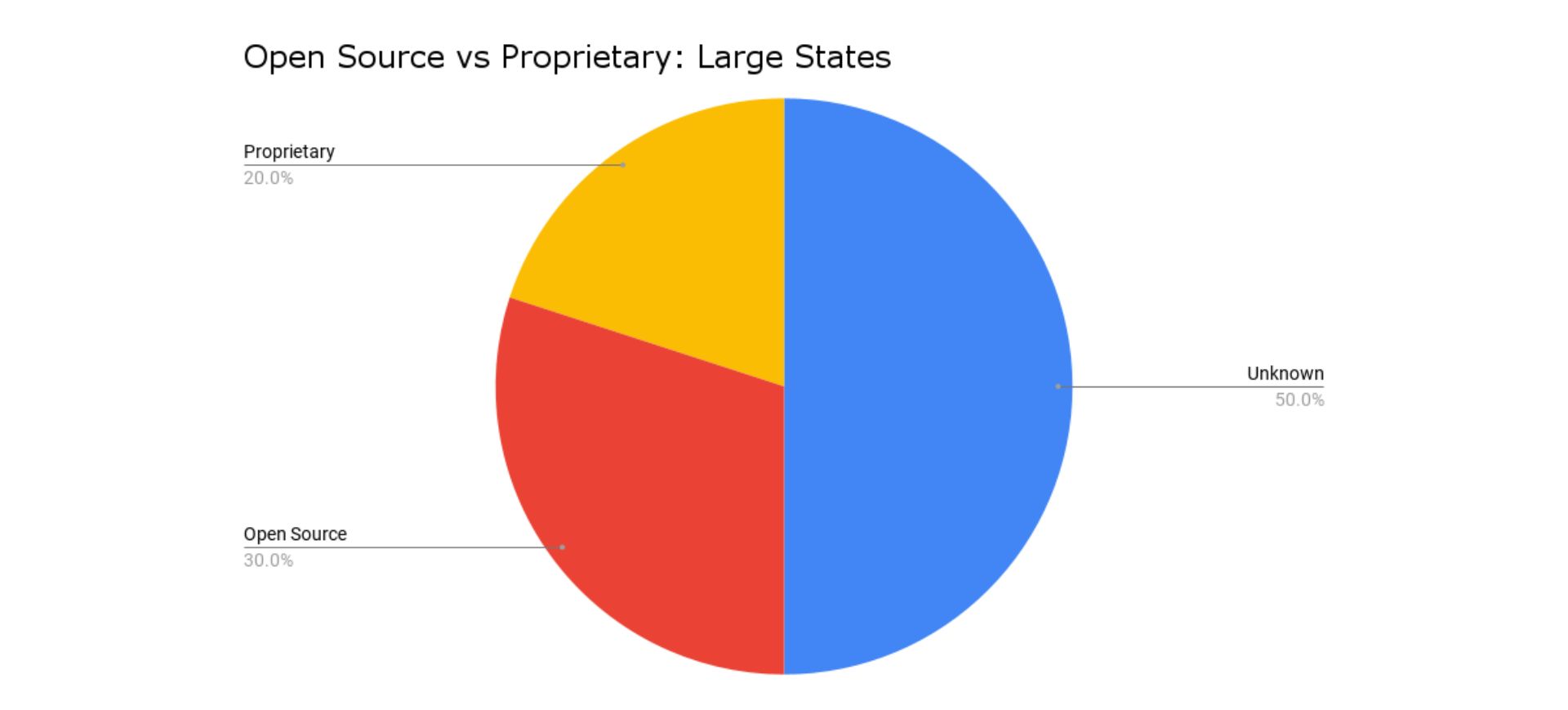

Open source vs proprietary split for large States:

- Open-source solutions account for 30% of CMS usage

- Proprietary solutions account for 20%

- Unidentifiable CMS usage is significant for large States at 50%

Comparison across State sizes

Key insights on CMS usage trends:

- Drupal consistently leads across all State sizes, with its usage increasing as state size grows (22.2% in small, 26.1% in mid-sized, 30% in large)

- WordPress usage decreases as State size increases (11.1% in small, 8.7% in mid-sized, not present in large)

- Adobe Experience Manager gains prominence in larger States (absent in small, 8.7% in mid-sized, 20% in large)

- Microsoft SharePoint is notably absent in large States, despite having a presence in small and mid-sized States

Open source vs proprietary trends:

- Open source preference remains strong across all State sizes but shows a slight decrease in large States (38.9% in small, 39.1% in mid-sized, and 30% in large)

- Proprietary solutions see increased adoption from small to mid-sized States, but this trend doesn't continue linearly to large States (5.6% in small, 30.4% in mid-sized, 20% in large)

- Unknown CMS usage follows a U-shaped curve (55.6% in small, 30.4% in mid-sized, 50% in large)

Key insights for States:

- Drupal's increasing popularity as State size grows suggests it may be better suited for handling the complex needs of larger State governments (we have a comparison of Drupal vs WordPress where we discuss scalability and complexity).

- Small States have the lowest adoption of proprietary solutions, possibly due to budget constraints or simpler requirements that can be met by open-source options.

- The mid-sized States show the highest adoption of proprietary solutions. This could be due to increased resources and more complex needs compared to small States, leading them to invest in commercial platforms.

- Large States show a moderate level of proprietary solution adoption, lower than mid-sized States but higher than small States. This could be because:

- They might have the resources and expertise to develop custom solutions (reflected in the high percentage of unknown CMS usage).

- They might find that certain open-source solutions (like Drupal) can scale to meet their complex needs.

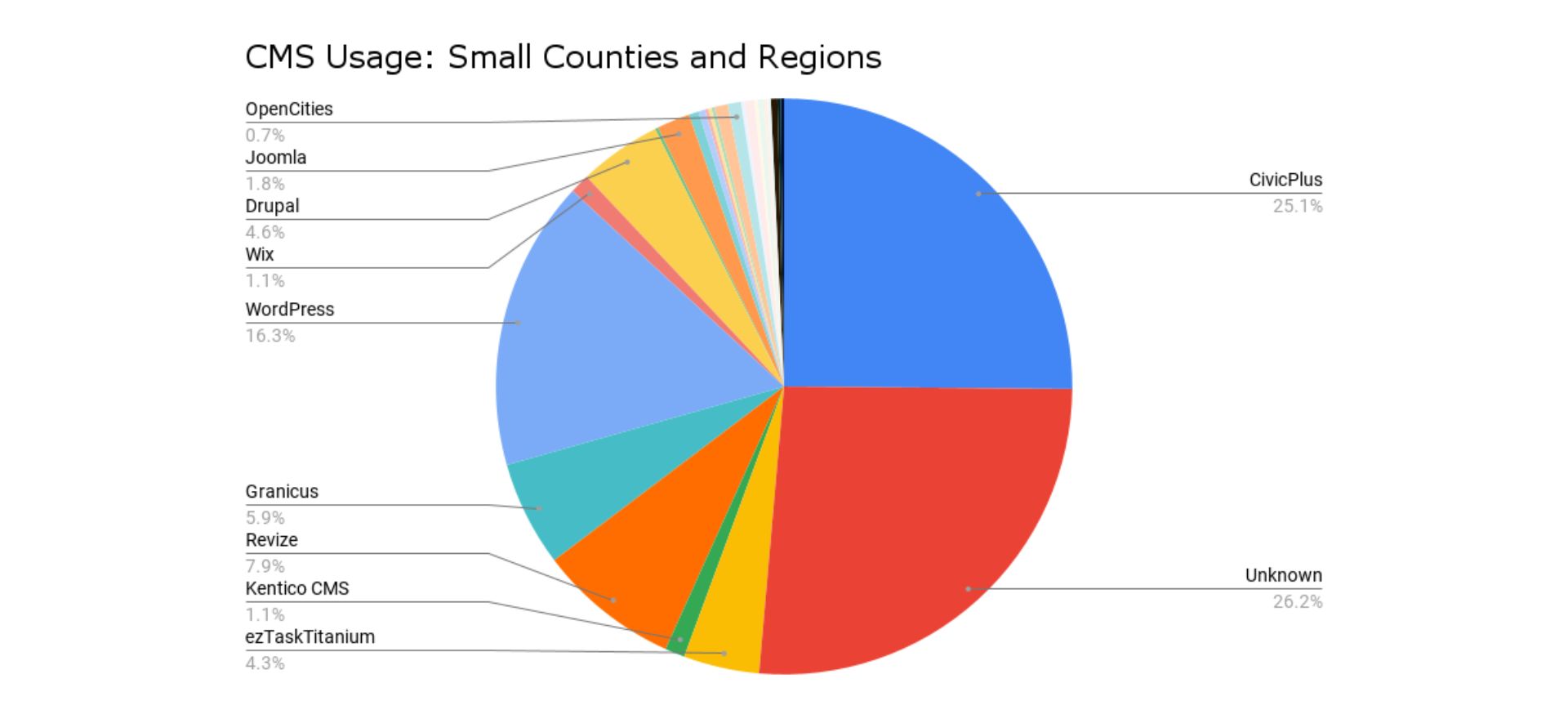

Analysis for small counties and regions (less than 150,000 residents)

Key findings for CMS usage of small counties:

- CivicPlus leads with 25.1% market share

- WordPress follows at 16.3%

- Revize is third at 7.9%

- Granicus and Drupal are next at 5.9% and 4.6% respectively

- 26.2% use unknown or unidentifiable CMS platforms

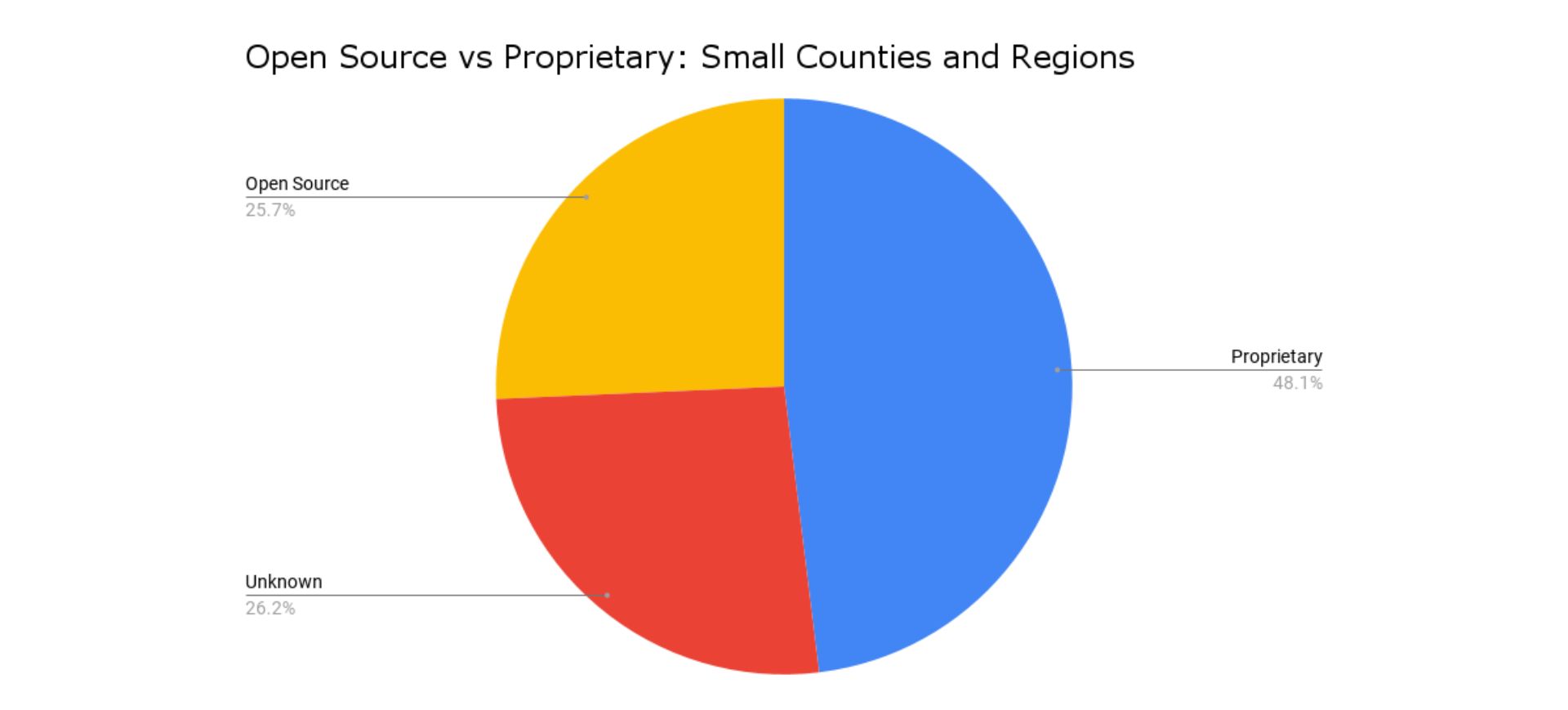

Open source vs proprietary split for small counties:

- Proprietary solutions dominate at 48.1%

- Open Source solutions account for 25.7%

- Unknown CMS usage is 26.2%

Key insights for small counties and regions:

- CivicPlus, a platform designed specifically for local governments, leads the market. This suggests that small counties and regions value specialized solutions tailored to their needs.

- WordPress has a significant market share, indicating that many small counties and regions opt for this popular, user-friendly, open-source platform.

- Unlike States, small counties show a clear preference for proprietary solutions. This could be due to the prevalence of government-specific platforms like CivicPlus and Revize, which offer tailored features and support.

- While lower than proprietary usage, open-source platforms still have a significant presence, primarily driven by WordPress and Drupal.

- The percentage of unidentifiable CMS usage (26.2%) is lower than what we observed in States, suggesting that small counties might be more likely to use identifiable, off-the-shelf solutions.

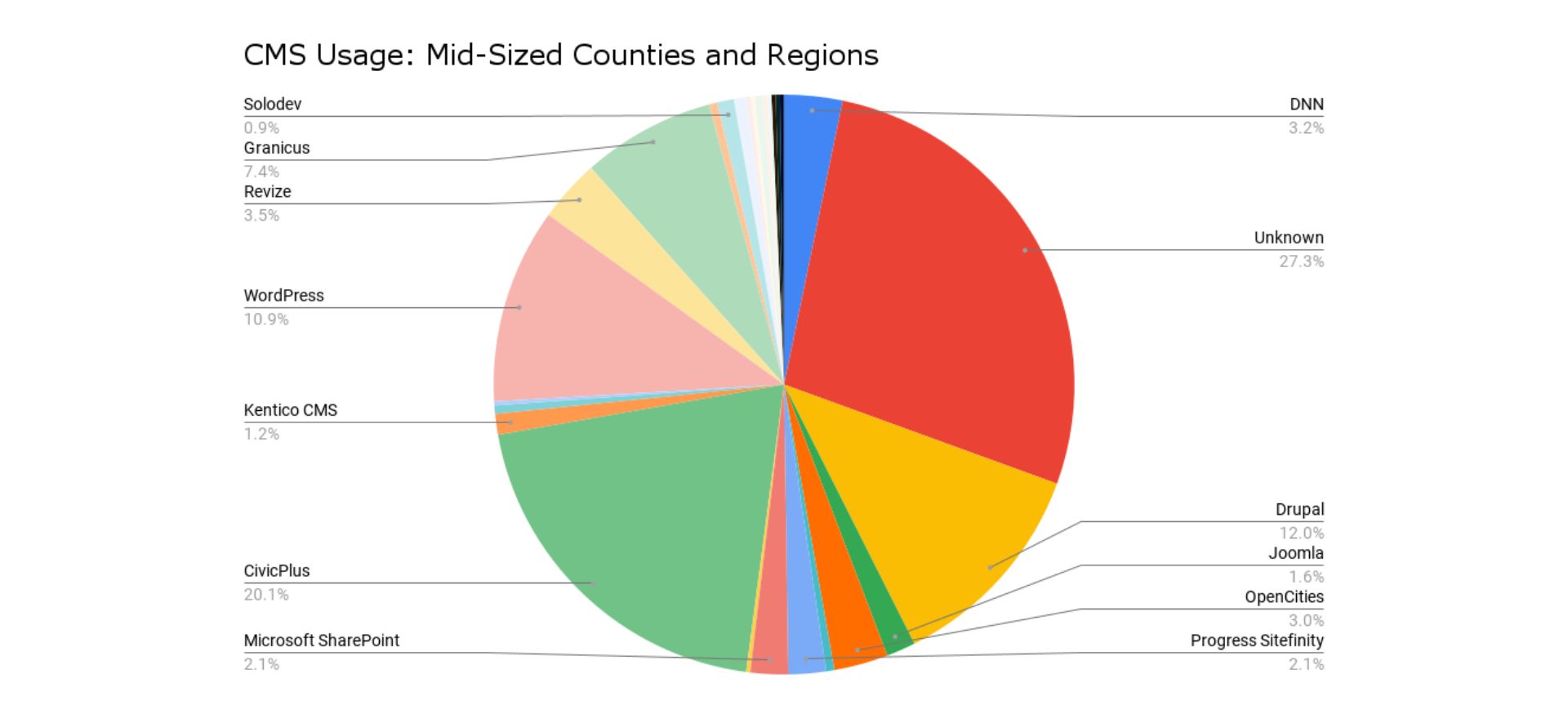

Analysis for mid-sized counties and regions (150,000 to 1.5 million residents)

Key findings for CMS usage of mid-sized counties:

- CivicPlus remains the leader at 20.1%

- Drupal takes second place at 12.0%

- WordPress follows closely at 10.9%

- Granicus is fourth at 7.4%

- 27.3% use unidentifiable CMS platforms

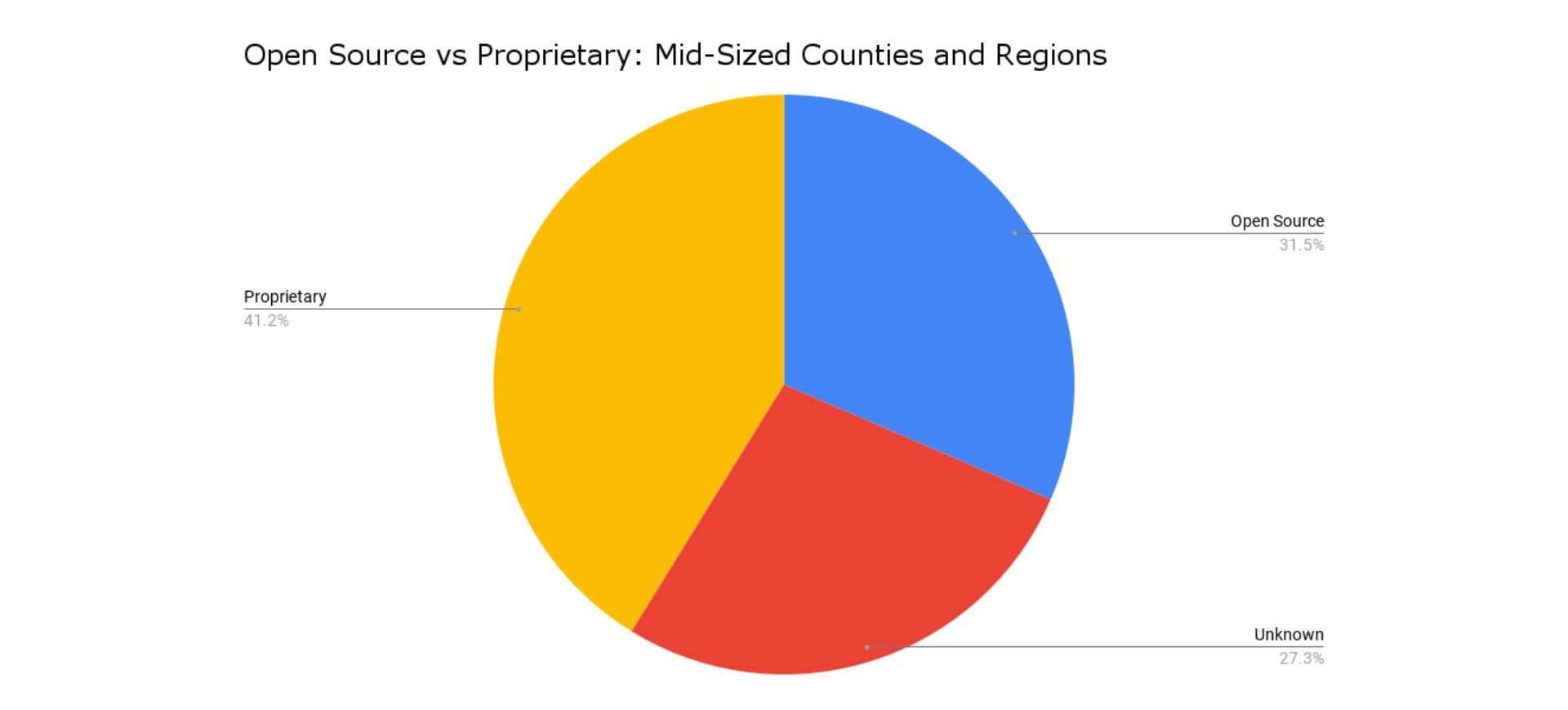

Open source vs proprietary split for mid-sized counties:

- Proprietary solutions lead at 41.2%, a slight decrease from small counties

- Open-source solutions account for 31.5%, higher than in small counties

- Unknown CMS usage is 27.3%, a slight increase from small counties

Key insights for mid-sized counties:

- While proprietary solutions still lead, there's a notable shift towards open-source platforms in mid-sized counties and regions. This could be due to increased technical resources and a desire for more customization options.

- Drupal's significant increase in usage suggests that as counties grow, they may require more complex and scalable solutions that Drupal can provide.

- Mid-sized counties show a more diverse CMS landscape, with the appearance of additional enterprise-level solutions. This suggests more varied needs and possibly larger budgets for CMS implementation.

- CivicPlus remains the leading platform despite the decrease, indicating that specialized government solutions continue to be valued even as entity size increases.

- While there's a slight decrease, WordPress maintains a strong presence, suggesting its continued relevance for government websites across different size categories.

- The slight increase in unidentifiable CMS usage could indicate that some mid-sized counties and regions are opting for more customized or less common solutions as their needs become more complex.

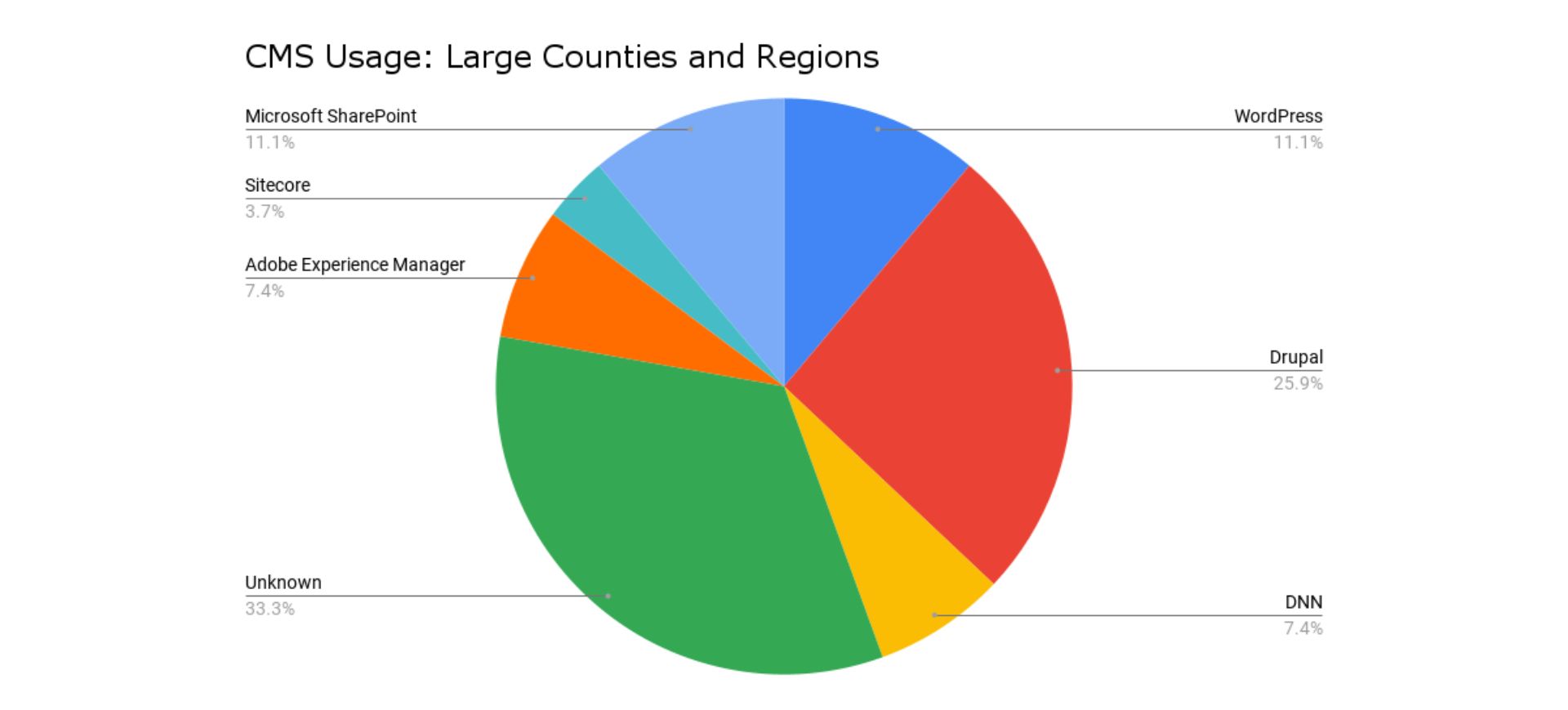

Analysis for large counties and regions (more than 1.5 million residents)

Key findings for CMS usage of large counties:

- Drupal leads with a significant 25.9% market share

- WordPress and Microsoft SharePoint tie for second at 11.1% each

- Adobe Experience Manager and DNN both have a 7.4% share

- Sitecore follows at 3.7%

- 33.3% use unidentifiable CMS platforms

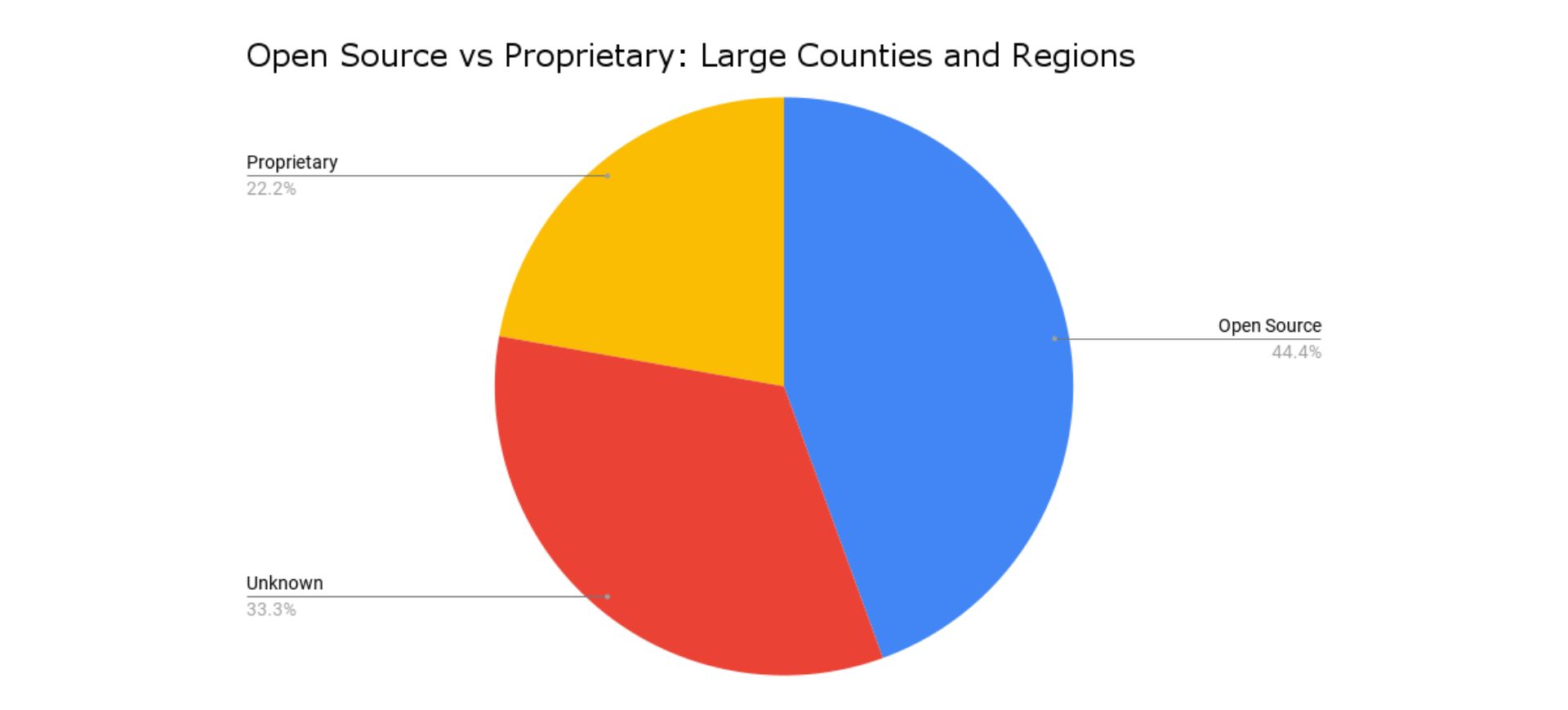

Open source vs proprietary split for large counties:

- Open-source solutions dominate at 44.4%

- Proprietary solutions account for 22.2%

- Unknown CMS usage is 33.3%

Comparison across county and region sizes

Key insights on CMS usage trends:

- Drupal's usage increases significantly as entity size grows (4.6% in small, 12.0% in mid-sized, 25.9% in large)

- WordPress maintains a consistent presence across all sizes (16.3% in small, 10.9% in mid-sized, 11.1% in large)

- CivicPlus, the leader in small and mid-sized counties/regions, is absent in large entities

- Enterprise solutions like Microsoft SharePoint and Adobe Experience Manager gain prominence in large entities

Open source vs proprietary trends:

- There is a clear shift towards open-source solutions as entity size increases (25.7% in small, 31.5% in mid-sized, 44.4% in large)

- Proprietary solutions decrease in share as entity size grows (48.1% in small, 41.2% in mid-sized, 22.2% in large)

- Unidentifiable CMS usage increases with entity size (26.2% in small, 27.3% in mid-sized, 33.3% in large)

Key insights for counties:

- Large counties and regions show a strong preference for open-source solutions, particularly Drupal. This is a significant shift from the proprietary dominance in smaller entities.

- Drupal's increasing popularity as entity size grows suggests it's well-suited for handling the complex needs of larger government organizations.

- Platforms like CivicPlus and Granicus, which were popular in smaller entities, are absent in large counties and regions. This suggests that larger entities may outgrow these solutions and require more customizable platforms.

- The appearance of Adobe Experience Manager and increased usage of Microsoft SharePoint indicate that large counties and regions are more likely to invest in enterprise-grade CMS solutions.

- WordPress maintains a steady presence across all sizes, demonstrating its versatility and appeal even for larger government entities.

- The higher percentage of unidentifiable CMS usage in large entities could indicate more frequent use of custom-built solutions or less common enterprise platforms.

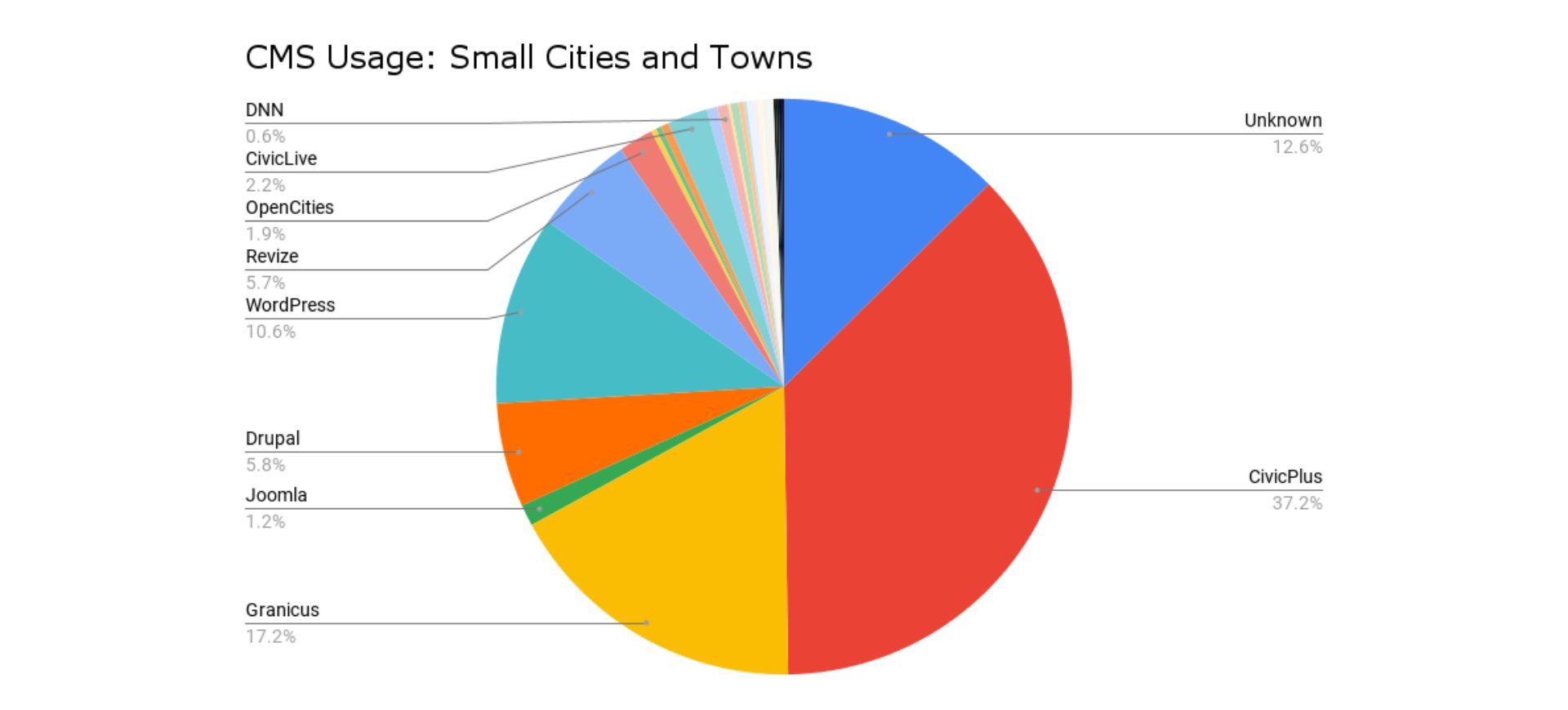

Analysis for small cities and towns (less than 100,000 residents)

Key findings for CMS usage of small cities:

- CivicPlus dominates with a significant 37.2% market share

- Granicus follows at 17.2%

- WordPress is third at 10.6%

- Drupal has a 5.8% share

- 12.6% use unknown CMS platforms

Read: Drupal vs Joomla: A Breakdown for Municipal Websites →

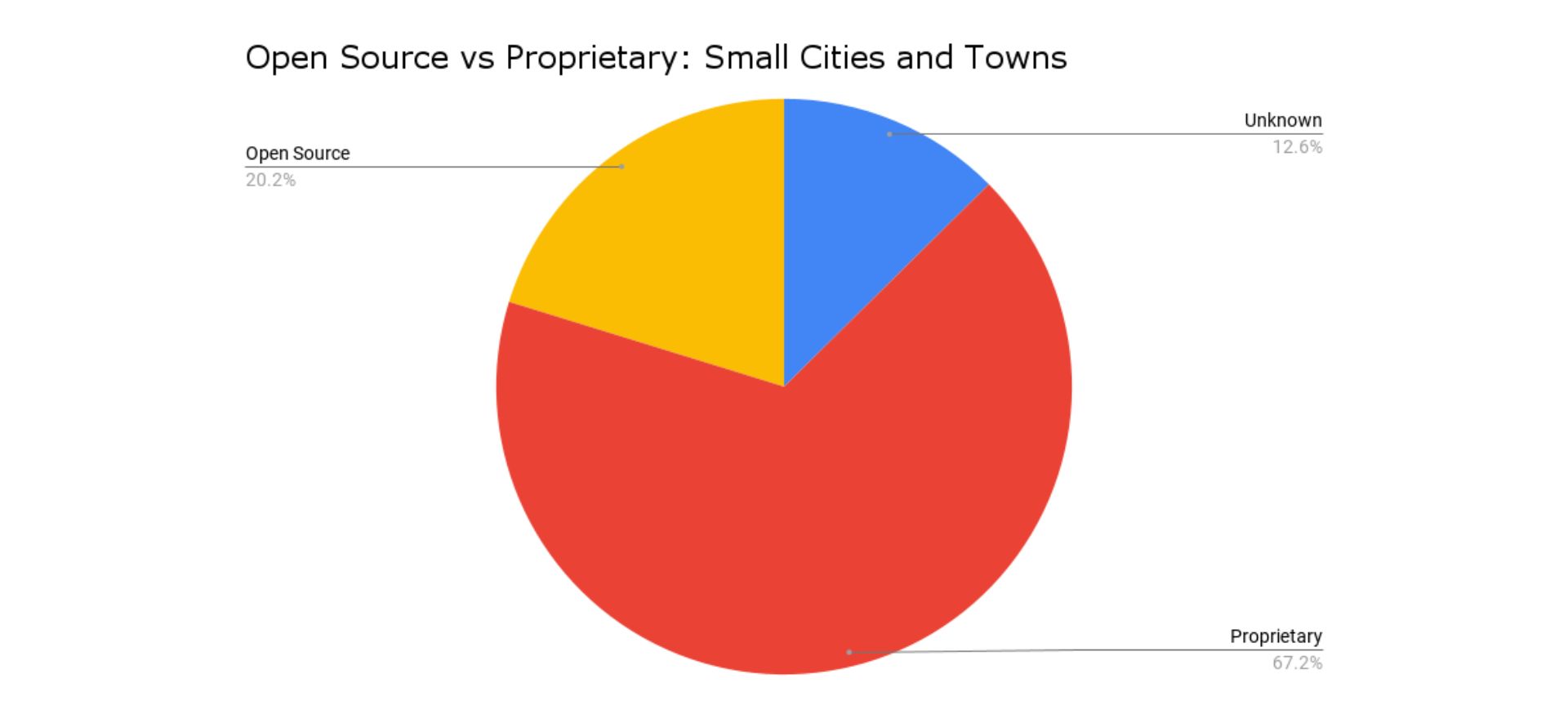

Open source vs proprietary split for small cities:

- Proprietary solutions heavily dominate at 67.2%

- Open-source solutions account for only 20.2%

- Unknown CMS usage is 12.6%

Key insights for small cities:

- CivicPlus and Granicus, both designed specifically for local governments, together account for over 54% of the market. This indicates a strong preference for specialized solutions tailored to municipal needs.

- There's a clear preference for proprietary solutions among small cities, significantly higher than what we observed in counties and regions of any size.

- While not as dominant as in counties, WordPress still maintains a significant presence, suggesting its appeal to smaller municipalities.

- The percentage of unidentifiable CMS usage is lower compared to counties and regions, indicating that small cities and towns are more likely to use identifiable, off-the-shelf solutions.

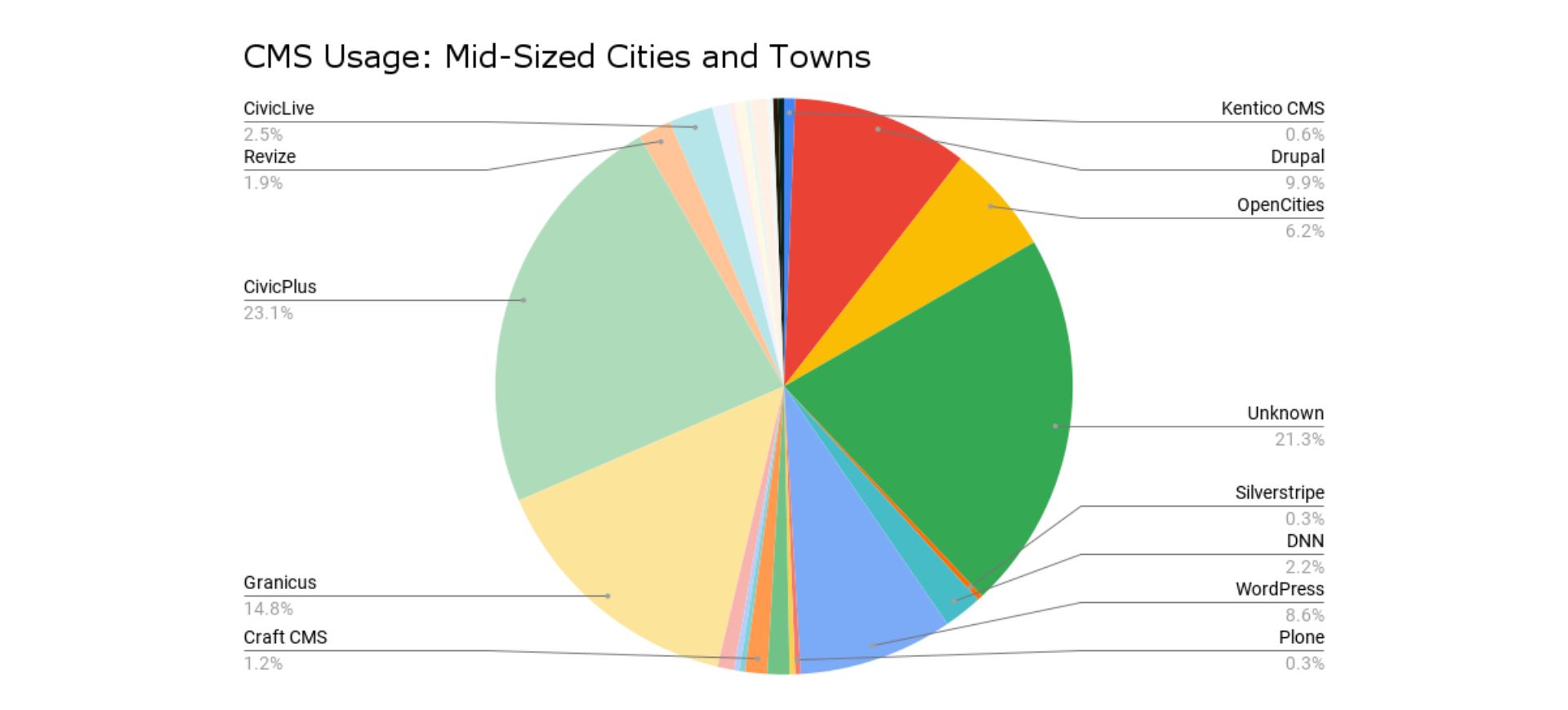

Analysis for mid-sized cities and towns (100,000 to 1 million residents)

Key findings for CMS usage of mid-sized cities:

- CivicPlus continues to have the highest share at 23.1%

- Granicus follows at 14.8%

- Drupal is at 9.9%, followed closely by WordPress at 8.6%

- OpenCities is at its highest at 6.2%

- Unidentifiable CMS usage is higher for mid-sized cities compared to small cities at 21.3%

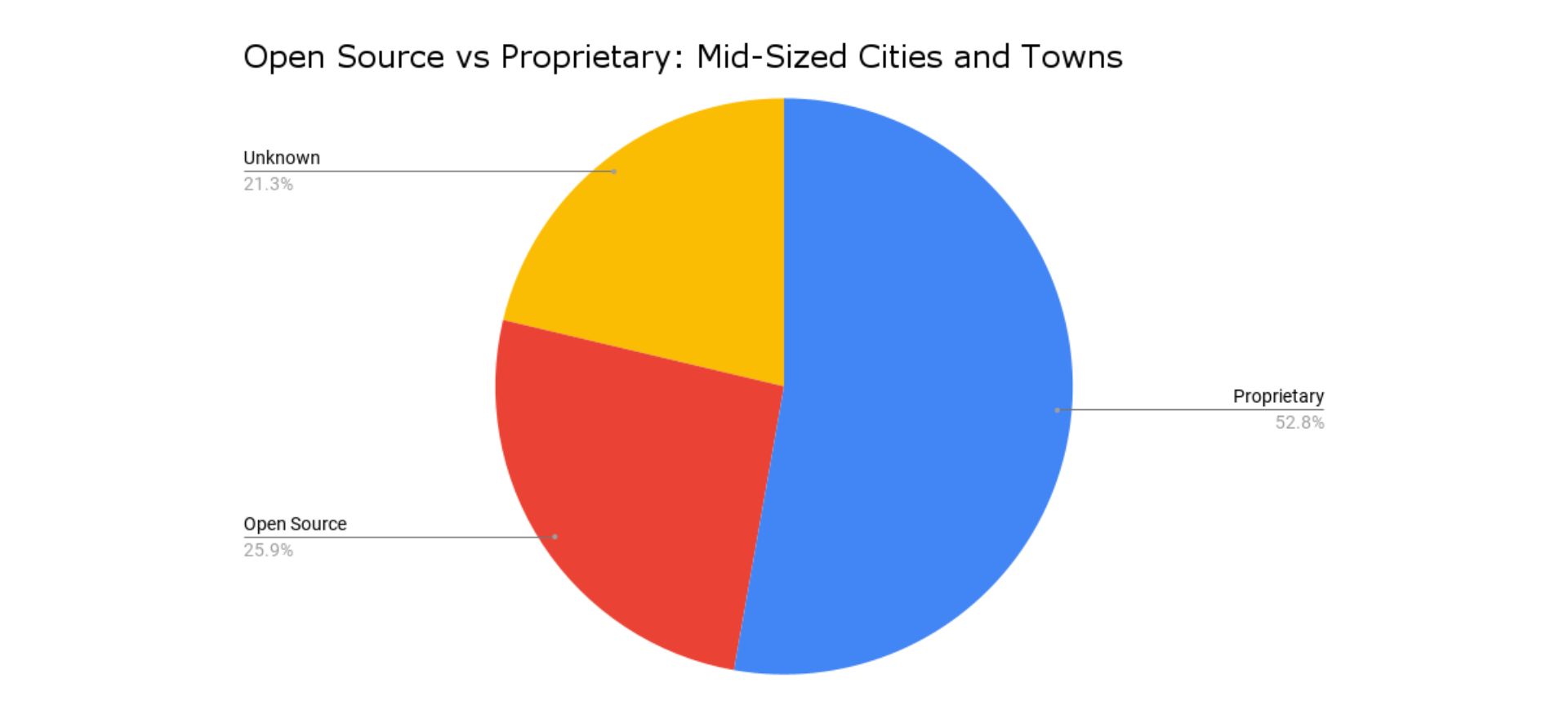

Open source vs proprietary split for mid-sized cities:

- Proprietary solutions once again dominate but with a slight decrease at 52.8%

- There is a slightly higher adoption of open-source solutions at 25.9%

- Unidentifiable platforms have also risen as mentioned earlier to 21.3%

Key insights for mid-sized cities:

- While their market share has decreased, CivicPlus and Granicus are still in the lead, showing the continued value of specialized government solutions even for mid-sized cities.

- Drupal’s increase in adoption (5.8% in small cities to 9.9% in mid-sized cities) suggests a shift towards more scalable solutions as city size increases.

- Mid-sized cities show a more diverse CMS landscape compared to small cities, with the addition of platforms like Craft CMS, Kentico CMS, and Plone.

- While proprietary solutions still lead, there’s a slight shift towards open-source platforms.

- The increase in unidentifiable CMS usage could indicate that some mid-sized cities opt for more customized or less common solutions as their needs become more complex.

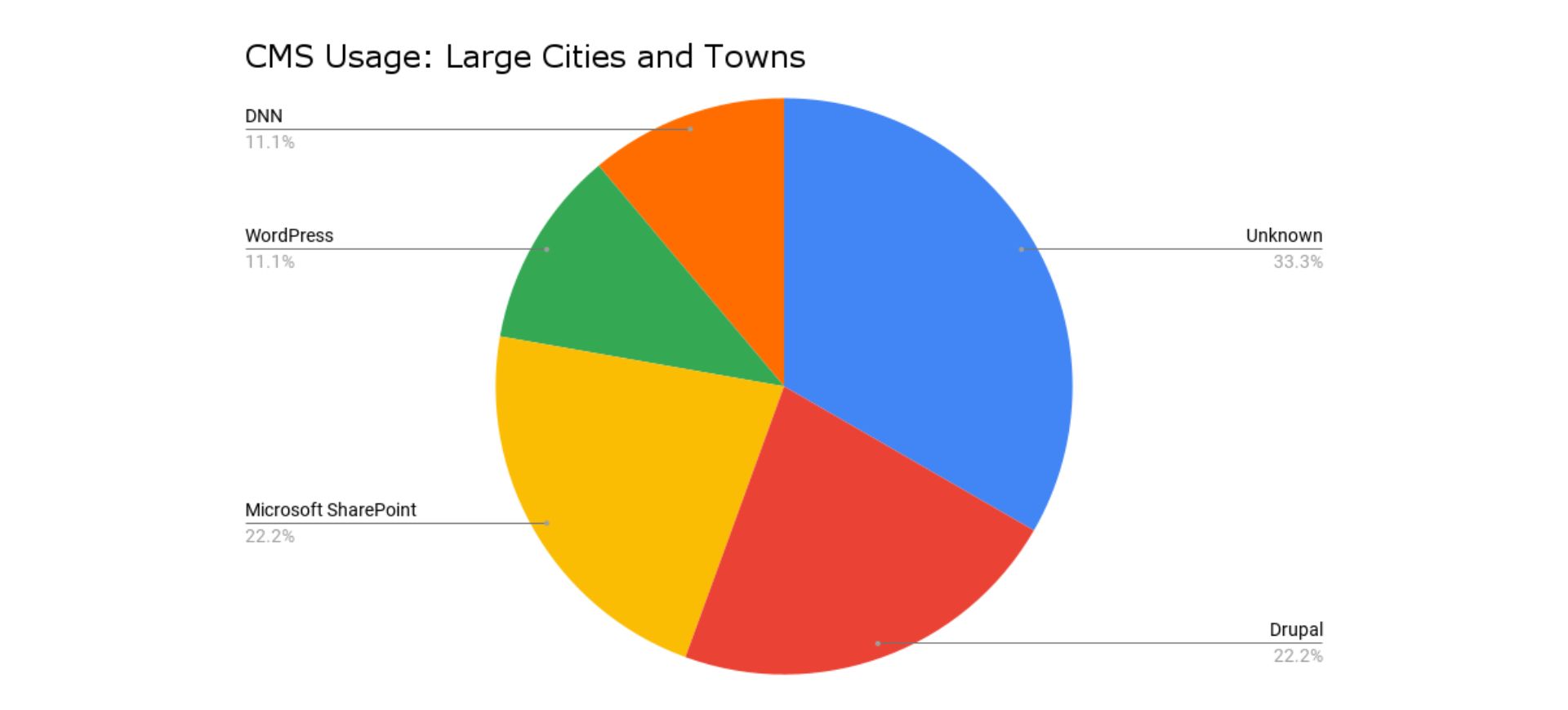

Analysis for large cities and towns (more than 1 million residents)

Key findings for CMS usage of large cities:

- Microsoft SharePoint and Drupal tie for the lead, each with 22.2% market share

- DNN and WordPress tie for third place, each with 11.1% market share

- 33.3% use unidentifiable CMS platforms

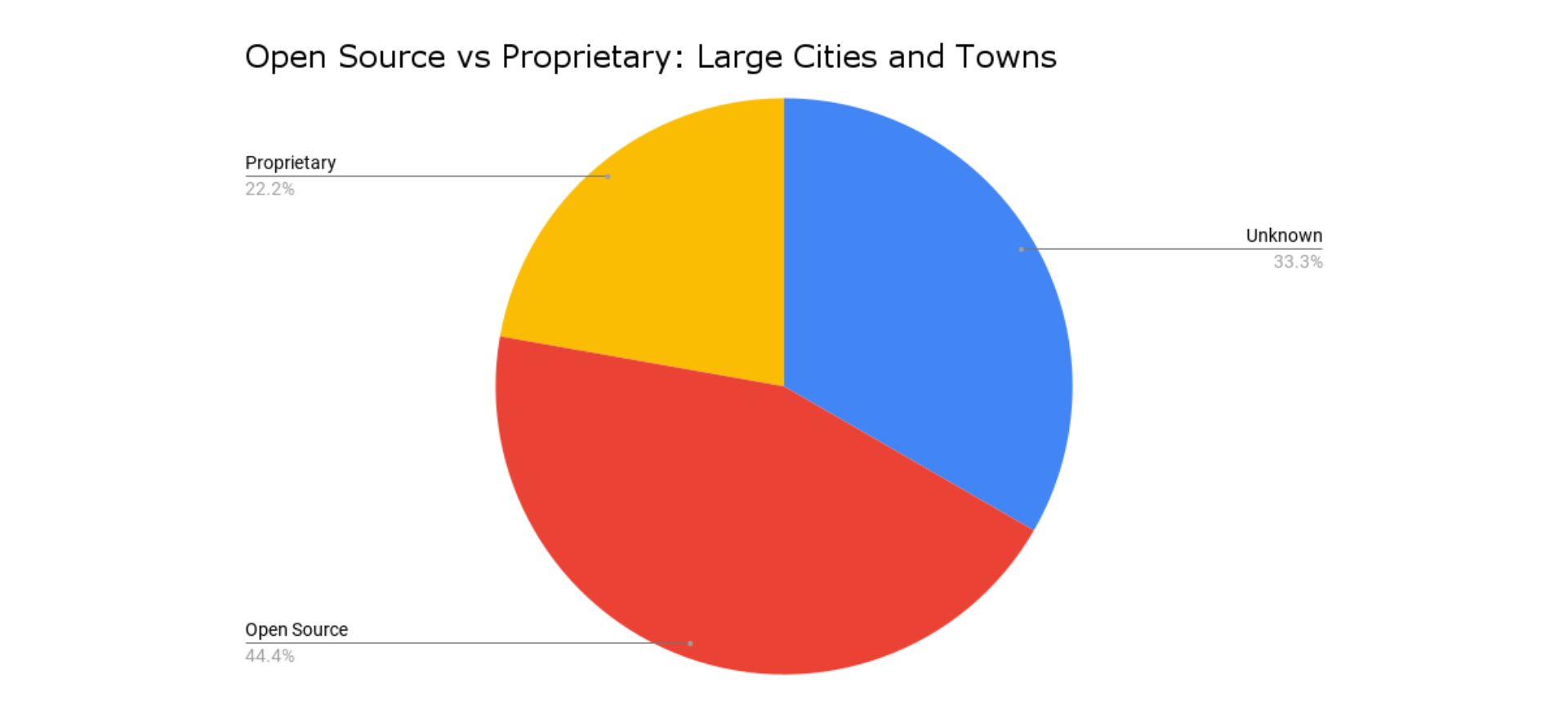

Open source vs proprietary split for large cities:

- Open-source solutions now lead at 44.4%

- Proprietary solutions have decreased to only 22.2%

- Unknown CMS usage also has risen to 33.3%

Comparison across city and town sizes

Key insights on CMS usage trends:

- Drupal's usage increases significantly as entity size grows (5.8% in small, 9.9% in mid-sized, 22.2% in large)

- DNN also gains prominence in large cities (0.6% in small, 2.2% in mid-sized, 11.1% in large)

- WordPress maintains a consistent presence across all sizes (10.6% in small, 8.6% in mid-sized, 11.1% in large)

- Microsoft SharePoint emerges as a major player in large cities (not significant in small or mid-sized)

- CivicPlus and Granicus, leaders in small and mid-sized cities, are notably absent in large cities

Open source vs proprietary trends:

- Similar to counties, we see a clear shift towards open-source solutions as the population size increases (20.2% in small, 25.9% in mid-sized, 44.4% in large)

- Proprietary solutions also decrease in share as population size grows (67.2% in small, 52.8% in mid-sized, 22.2% in large)

- Unidentifiable CMS usage also increases with entity size (12.6% in small, 21.3% in mid-sized, 33.3% in large)

Key insights for cities:

- Large cities and towns strongly prefer open-source solutions, particularly Drupal. This is a significant shift from the proprietary dominance in smaller entities.

- The emergence of Microsoft SharePoint as a leading solution suggests that large cities are more likely to invest in enterprise-grade CMS solutions.

- Platforms like CivicPlus and Granicus, while popular in smaller entities, are absent in large cities. This suggests that larger entities may outgrow these solutions and require more customizable platforms.

- WordPress maintains a steady presence across all sizes, demonstrating its versatility and appeal even for larger government entities.

- The higher percentage of unidentifiable CMS in large entities could indicate more frequent use of custom-built solutions or less common enterprise platforms.

Which CMS should you choose? Our recommendations based on the data

The study clearly shows that CMS needs vary significantly based on government level and entity size. Decision-makers should consider these factors when selecting a CMS. Just because a platform is government-specific does not automatically mean it is the best choice.

Factors to consider when choosing between open-source and proprietary CMS options

- Available resources: Larger entities tend to favor open-source solutions like Drupal, possibly due to greater in-house technical resources. Consider your IT team's capabilities when choosing between open-source and proprietary options.

- Customization needs: Open-source solutions offer more flexibility for customization, which may be crucial for larger or more complex government websites.

- Specialized features: Proprietary, government-specific solutions like CivicPlus and Granicus are popular among smaller entities, likely due to their out-of-the-box features tailored to local government needs.

- Support and maintenance: Proprietary solutions often come with dedicated support, which may be valuable for entities with limited IT resources. Open-source solutions, on the other hand, encourage vendors to bring their support A-game since there is no vendor lock-in.

- Cost considerations: While open-source solutions are free to use, factor in potential costs for customization, hosting, and maintenance when compared with proprietary options.

Using population size and government-level data to inform decision-making

- State-level entities: Consider open-source solutions, particularly Drupal, which shows increasing popularity as State size grows. For small States with fewer resources, WordPress may also be a viable option.

- County-level entities:

- Small counties: Consider proprietary, government-specific solutions like CivicPlus or open-source platforms like WordPress.

- Mid-sized counties: Explore a mix of open-source (Drupal, WordPress) and proprietary options.

- Large counties: Lean towards open-source solutions like Drupal or enterprise-grade options like Microsoft SharePoint.

- City-level entities:

- Small cities: Consider government-specific proprietary solutions like CivicPlus or Granicus, or even WordPress if you have a limited budget.

- Mid-sized cities: Explore a mix, with a slight preference for proprietary solutions but increased consideration of open-source options.

- Large cities: Consider open-source solutions like Drupal or enterprise solutions like Microsoft SharePoint.

Other key considerations for choosing a government CMS

- Scalability: Choose a CMS that can grow with your entity's needs. The increasing popularity of Drupal among larger organizations is consistent with its claims of scalability.

- Security: Government websites are prime targets for cyberattacks. Ensure your chosen CMS has robust security features and regular updates.

- Accessibility: Your CMS should support the creation of websites that meet accessibility standards for all citizens.

- Integration capabilities: Consider how well the CMS integrates with other government systems and third-party services you use or plan to use.

- User experience: Both for citizens accessing the website and staff managing content, the CMS should offer an intuitive and efficient user experience.

- Mobile responsiveness: With increasing mobile usage, ensure your CMS supports responsive design out of the box.

- Community and ecosystem: For open-source options, consider the size and activity of the developer community. For proprietary solutions, evaluate the vendor's track record and long-term viability.

- Migration considerations: When migrating your government website from one CMS to another, consider the complexity of the migration process and any potential downtime.

Remember, while this study provides valuable insights, your government entity has unique needs and constraints. Use these recommendations as a starting point, but conduct a thorough evaluation based on your requirements before making a final decision.

Need a scalable, open-source option? Consult with our team for your migration to Drupal

Conclusion: Government level and size affect CMS preferences

This study reveals several key findings that help show nuances in CMS usage across U.S. government entities. Overall, proprietary solutions dominate, accounting for 52.4% of usage compared to 25.8% for open-source solutions.

However, just looking at this statistic doesn’t account for the differences based on government level and population size.

Government level variations:

- States show a preference for open-source solutions, particularly Drupal.

- Cities favor proprietary, government-specific platforms like CivicPlus and Granicus.

- Counties also tend to lean more toward proprietary solutions despite the slight increase in preference towards open-source platforms.

Size-based trends:

- Larger entities across all levels tend to shift towards open-source solutions, especially Drupal.

- Smaller entities, particularly cities and counties, prefer proprietary, government-specific platforms.

- Enterprise-grade solutions like Microsoft SharePoint gain prominence in larger entities.

Consistent performers:

- WordPress maintains a steady presence across all government levels and sizes, with large States being the only exception.

- Drupal's popularity increases with entity size across all levels.